Dear Mr. Berko: We bank at Fifth Third Bank and own 1,000 shares of the stock, which you advised us to buy in 2009 at $7.75 a share. I like the stock’s performance, but when I bragged to friends (a retired banker and his wife) about our good fortune ($16,250 profit), both told me to sell the stock because “the scummy management in the home office doesn’t know what the branch offices are doing.” They also bank at Fifth Third. They’d like to change banks, but automatic deposit instructions (from Social Security, dividends, annuities, investment mortgages, royalties, etc.) become too complicated, so they’d wind up missing some payments that would get stuck in limbo. They don’t like Fifth Third’s policy of changing the staff and tellers every few months, as it’s confusing to bank with strangers. We have noticed this, too, and are concerned enough to sell the stock if you say so. — Confused in Cleveland

Dear Confused in Cleveland: Fifth Third Bank (FITB-$24), headquartered in Cincinnati since 1862, is a $14 billion-asset bank with over 1,250 branch offices. Its niggardly 56-cent dividend yields 2.1 percent, and your banker friend’s complaints are not unusual; FITB seems to be having a management problem.

You alluded to one reason the service and operations at some FITB branches are unacceptable. Neurotic management doesn’t want depositors to become friendly with the branch staff, so about every six months, FITB tellers, managers and other personnel play musical chairs and move to alternate FITB bank locations. Another reason for dinky service is that Cincinnati’s toadeaters keep branch labor costs low with skeletal crews, causing frustratingly long waits for customers making deposits or conducting business.

Go to Google. Enter “complaints Fifth Third Bank” and read from a menu of innumerous grievances, gripes, grumbles and grouses. The extent and range of that content will knock your socks off.

So the problem is not FITB’s branch personnel, most of whom are wonderful, diligent and fine folks. Rather, the problem is the ignorant simpletons who run FITB’s “central command” headquarters, which coordinates each branch with Cincinnati. It’s often said that management hires employees in its own image; that’s scary and concerning. Customers complain of unauthorized fees, letters to dead spouses, incorrect charges, stinky service, credit card lockups, surprise fees, charges for cash deposits, hidden expenses, refusal to honor promised interest rates and myriad mucked-up and confusing levies, charges and tariffs on business accounts, personal loans, standard checking accounts and mortgages. FITB’s business plan reminds me of Wells Fargo’s.

You’ve already enjoyed a big gain from FITB, and I don’t think there’s much left. Though FITB doubled its share price last year, near-term projections look bleak. This year’s revenues will be up a jot from 2016, but Morningstar reckons that 2017 earnings will be $1.75 a share, down a dime from last year’s $1.85. Despite lower earnings, the board may increase the dividend by 2 cents a quarter.

There are 30 analysts who follow FITB, and their consensus suggests a high target price of $30, a low target price of $22 and a median target of $27. Such brokerages as Nomura Securities, Sanford C. Bernstein, Robert W. Baird, Jefferies and Morgan Stanley have downgraded FITB to “hold.” The designation “hold” is often used by the brokerage industry rather than “sell.” The term “sell” has a negative connotation that brokerages seek to avoid because of the possibility of future business. For example, a “sell” opinion on FITB would look bad if the brokerage were to seek investment banking business from FITB down the line. However, several bold brokerages publicly rate FITB a “sell.”

In November, many senior FITB executives — CEO Greg Carmichael, Treasurer James Leonard, then-Executive Vice President Chad Borton, EVP Frank Forrest and Chief Strategy Officer Tim Spence — liquidated over 200,000 shares, worth over $50 million. I’m disappointed that senior officers and directors own less than 1 percent of Fifth Third Bank’s stock. It suggests that management isn’t bullish on its own company. Therefore, I recommend that you take that $16,250 profit and support management’s lack of confidence in FITB. These guys know better than you.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Theater Groups in South Florida Receive Grant Funding for Shakespeare Remake

The funds will allow a modern-day generational comedy take on Shakespeare’s Hamlet to be performed in Broward and Miami-Dade counties.

Build With Us @ Suffolk’s Business Accelerator Program Honors Minority Graduates

The company is one of the largest contractors in Florida.

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

Other Posts

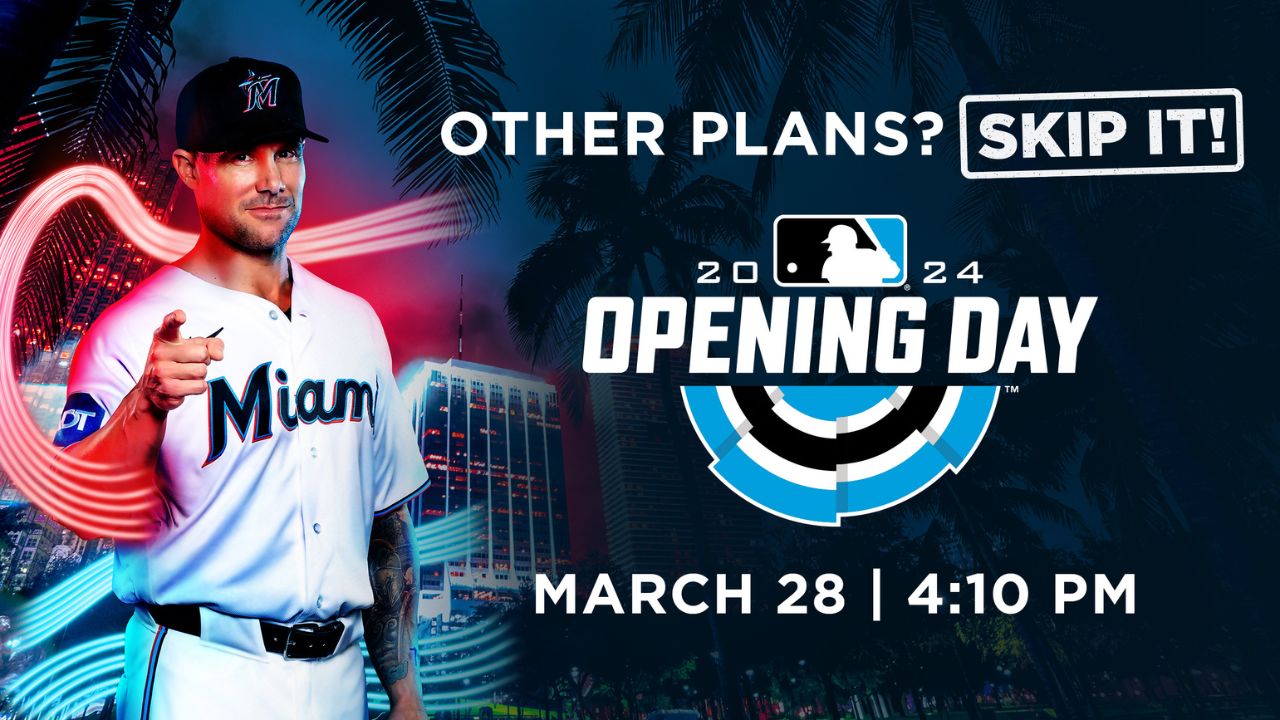

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.