Dear Mr. Berko: I recently subscribed to the Value Line Investment Survey. One of its analysts, Ian Gendler, is recommending buying stock in General Motors, the largest automaker in the world. Gendler says that GM has “strong volume and pricing and continues to reduce cost” and that “the firm is posting healthy financial results.” He says GM is planning to come out with three brand-new crossover models that “will help the company sustain the momentum in the quarters ahead.” According to Gendler, the 4.5 percent dividend is attractive and the stock has good investor appeal for excellent long-term growth in principal, earnings and dividends. Please give me your thoughts on General Motors and the Value Line Investment Survey. We have an $11,000 certificate of deposit coming due next week. The best renewal rate is 1.35 percent, so we would consider buying 300 shares of General Motors. — SZ, Vancouver, Wash.

Dear SZ: I’m sorry to disabuse you of this notion, but GM is no longer the largest automaker in the world. That title belongs to Toyota Motor Corp. Renault-Nissan Alliance claims the No. 2 spot. Volkswagen comes in third, followed by General Motors (GM-$33.69) and then Ford Motor Co. And Ian Gendler isn’t just an analyst at Value Line; he’s the executive director of research, and that means he has a lot of smarts. I’ve followed Gendler for several years. I’m impressed with his work, and I’d hire him in a Sioux City second if I could afford him. However, a subscription to the Value Line Investment Survey is the best alternative.

I may be wrong — and hope I am — but I don’t agree with Gendler’s bullish opinion of GM. After bleeding under the United Automobile Workers’ thumb for ages, in November 2010 GM emerged from an ignominious bankruptcy and sold 550 million shares in an initial public offering at $33. At that time, the Dow Jones industrial average was at 11,500. The Dow has almost doubled since then, and GM is still trading at $33. Hmm! Well, there’s a darn good reason for that. Though revenues, earnings and dividends have improved since 2010, they haven’t improved enough in the eyes of Wall Street’s movers and shakers to grow the value of the stock.

Some automakers are trimming production because of excess inventory on dealer lots. GM has laid off several thousand workers in Michigan and Ohio. Ford, sensing a slowdown, intends to pink slip 200,000 employees this year. Meanwhile, GM’s important net profit margins have been falling and may continue to fall through 2021. GM’s return on capital and its return on equity are also declining and could continue moving lower over the next few years.

I recently drove from Boca Raton to Fort Lauderdale on U.S. Highway 1, also called Federal Highway and also known as “automobile row.” I was gabberflasted and stunned looking at the thousands and thousands of shiny new vehicles squished together, side by side, tighter than pickles in a jam jar. And so it is in similar areas in St. Louis, Denver, Durham, Houston, Columbus and Cucamonga. There are more cars than affordable demand. Now the industry is holding its breath, bracing for a record 3.6 million off-lease vehicles that will flood the market as certified preowned cars this year. Some analysts believe that the used car market won’t be able to absorb this influx of vehicles.

I don’t want to say that the party is over, but the industry has enjoyed a historic run, thanks to new job growth, easy credit, huge cash rebates and generous lease programs. And even in America, good things must come to an end. I’m not expecting revenues to collapse, but I think there will be a return to a slightly less-than-normal demand. And I’d be disappointed if the United Automobile Workers union were not to become restless again and agitate for higher wages, better benefits and fewer work hours. No wonder six GM big shots have unloaded several hundred thousand shares of GM in the past 18 months.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Theater Groups in South Florida Receive Grant Funding for Shakespeare Remake

The funds will allow a modern-day generational comedy take on Shakespeare’s Hamlet to be performed in Broward and Miami-Dade counties.

Build With Us @ Suffolk’s Business Accelerator Program Honors Minority Graduates

The company is one of the largest contractors in Florida.

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

Other Posts

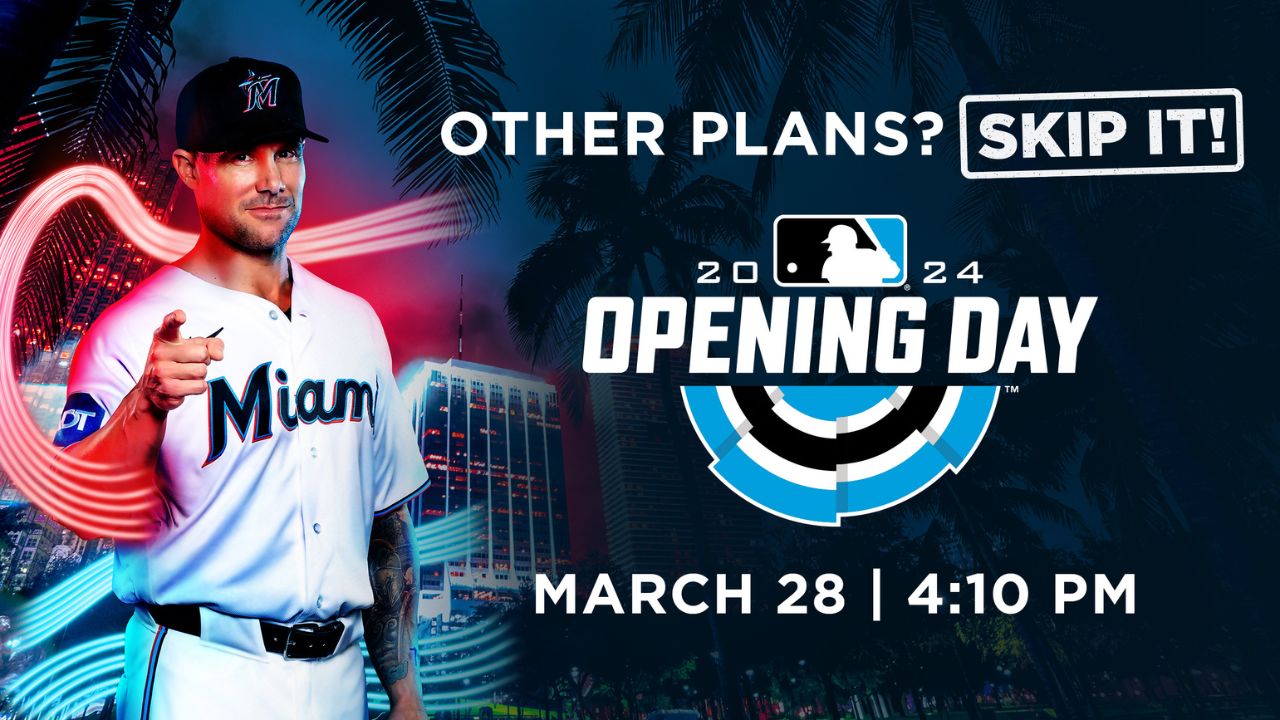

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.