Dear Mr. Berko: My wife and I have two questions. One concerns health savings accounts, and the other concerns Social Security. First, could you please explain the basics of an HSA and how someone qualifies? Next, my wife says our Social Security taxes have increased, but I say they have remained the same for the past 30 years. We’d appreciate your answer to settle our argument. — DD, Durham, N.C.

Dear DD: Years ago, it seemed that every time I responded to a question about health savings accounts or Social Security, some readers had better answers — and gladly let me know. So I’ve turned to Kristina Sommerkamp, a financial adviser in Boca Raton, Florida, who probably knows more about Social Security’s rules, regulations, administration, guidelines and governance than most of the homeboys who run this program from the bureaucratic swamp in Washington. Over the past 20 or more years, Kristina has helped many readers with immediate answers to questions that would take a high-level Social Security administrator a week to research. She also knows a great deal about HSAs, but let’s start with your second question.

According to Kristina, both of you are right and wrong. The tax rate (6.2 percent of your wages, which both you and your employer pay) has not been increased since 1990. However, the amount of money you and your employer have paid into Social Security has increased. The 229 disingenuous lawyers who sit in the House and the Senate are to blame. While the 6.2 percent tax rate has remained constant, the amount of your gross earnings subject to the SS tax has nearly doubled in the past 20 years. According to Kristina, your SS taxes in 1997 were based upon $65,400 in income, and 10 years later, that amount had grown by about 50 percent, to $97,500. Now, 10 more years later, your SS taxes are based upon an income of $127,200. So in 1997, your SS taxes were (6.2 percent of $65,400) $4,054. And in 2007, your taxes were $6,045. Today you’re donating $7,886 to the big slush fund in the sky — and so is your employer. Those increases are well above the inflation rate; however, the additional money is needed to pay Social Security benefits to millions (including noncitizens) who would not have qualified a dozen years ago. But what’s past is prologue. Many believe that during the next 10 years, the tax base will rise by about 55 percent, to $196,850, as Congress changes the rules and permits more people to qualify for the benefits you have paid for over your working life.

Health savings accounts are just as tricky as Social Security and have just as many whistles, bells, loopholes and crevasses. According to Kristina, you must have a high-deductible health plan to qualify for an HSA. This means your health plan deductible as an individual must be at least $1,300, and the amount is $2,600 for family coverage. And HSA contribution limits are $3,350 for individuals and $6,750 for families. But if you are older than 55, you can increase your contributions (called “catch-up”) by $1,000 a year. There are no income limits or requirements. You don’t need to seek permission from the IRS, and you can open an HSA with your broker, your credit union or an insurance company. The funds contributed to an HSA are not subject to federal taxes when deposited. The money that is not spent on “qualified medical costs” is rolled over and accumulates year to year for as long as you wish and can be used for retirement income. You can invest the money just as if it were in an individual retirement account, and the earnings are sheltered from federal taxation. Withdrawals for nonmedical or nonqualified expenses are treated like withdrawals from an IRA, including a 10 percent penalty. But be mindful that once you sign up for Medicare, you can’t contribute to an HSA.

Because they’re designed by Congress, HSAs are overcomplicated strategies. So Kristina recommends that you consult with an expert before opening an account to avoid potential problems.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Theater Groups in South Florida Receive Grant Funding for Shakespeare Remake

The funds will allow a modern-day generational comedy take on Shakespeare’s Hamlet to be performed in Broward and Miami-Dade counties.

Build With Us @ Suffolk’s Business Accelerator Program Honors Minority Graduates

The company is one of the largest contractors in Florida.

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

Other Posts

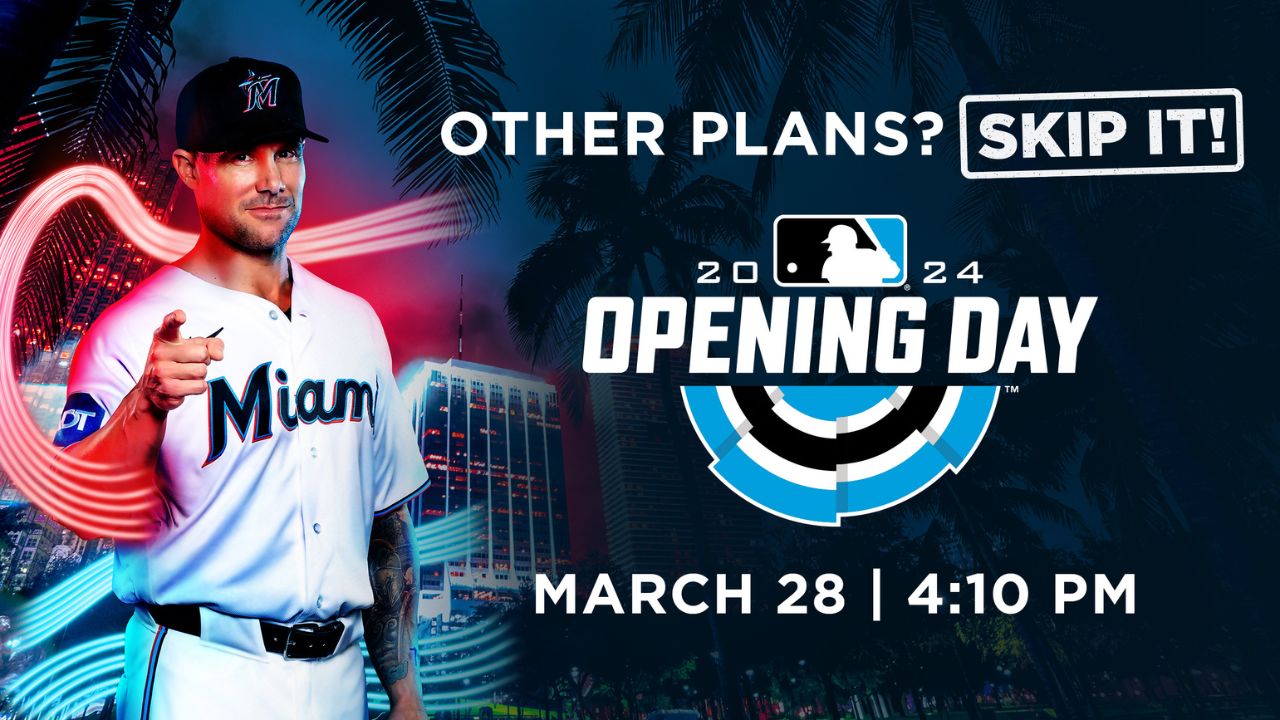

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.