Dear Mr. Berko: Please give me your opinion on DDR Corp., which yields 5.7 percent. I called Charles Schwab but had to call back three times to get an adviser. The adviser I worked with is no longer there, and this is my third adviser. What’s going on? I have a large account at Schwab (almost $600,000), and during the past couple of years, I’ve noticed a problem that bothers me. When I call Schwab’s home office, I have to wait three or four minutes to speak to someone to place a trade for a preferred stock or bond, transfer funds to my checking account or take a distribution from my individual retirement account. Is Schwab in financial trouble? I read that Schwab is encouraging employees to leave the firm. To prevent future problems, should I transfer my account to Fidelity? And should I sell my Schwab stock? — SS, Cleveland

Dear SS: I’m sorry to tell you that $600,000 is not a large account. It’s difficult to find a wise and experienced stockbroker if your account is less than a few million dollars. It’s even difficult to find a good broker if your account is worth more. Frankly, it doesn’t make a bit of difference which brokerage you use. Basically, except for minor differences in procedures, all brokerage firms are the same. Your success depends on employing a knowledgeable professional you can trust. Finding someone with whom you can confidently counsel makes all the difference in the world. To paraphrase Flannery O’Connor, a good broker is hard to find.

Charles Schwab (SCHW-$40) was founded in 1971. It’s a publicly traded company, so I have access to its financial statements. I can assure you that SCHW’s numbers are mighty impressive. And from conversations with industry executives, I assure you that SCHW has no financial worries. SCHW will be around for many, many more years. I’ve not heard a word about SCHW layoffs.

Many investors are no longer buying stocks. Rather, they’re shifting billions of dollars to low-cost investment products and index-based investments, which often perform better than actively managed funds. This has changed SCHW’s revenue mix, as fewer investors are paying advisers to actively manage their accounts.

SCHW doesn’t care if you have to wait three minutes or 12 minutes to speak with a Schwabman. And the folks in management won’t increase their payroll to shorten your wait, because they know you’ll eventually stop complaining and accept it. But moving your account to Fidelity would be figuratively hopping from the frying pan to the fire. SCHW, like Fidelity, wants to grow revenues and make as much money as possible for shareholders, but it wants to do so with as few employees as possible. Therefore, management counsels employees to work more smartly so they can be more productive. I understand that you can chew your nails to the nub waiting on hold for a Schwabman to answer the phone while having to listen to market updates and Schwab’s endless mind-numbing advertising. But when a Schwabman answers, he’s usually knowledgeable, warm, friendly, patient and efficient. Buy the stock.

And stay away from DDR (DDR-$13). DDR is a $904 million real estate investment trust that owns, develops, redevelops, leases and manages billions of tons of concrete, glass and steel shopping centers all over the U.S. and Puerto Rico. Today mall landlords are walking away from struggling properties and leaving creditors in the lurch. Nearby land values are declining, and there have been draconian losses. J.C. Penney, Sears, Nordstrom, Wal-Mart, American Eagle, Aeropostale, Office Depot, Macy’s, Chico’s, Finish Line and others are closing hundreds of stores because 1) many shoppers are uncomfortable buying merchandise from a kid with technicolor tattoos and piercings up the wazoo who doesn’t give a fig whether he makes a sale and 2) the internet makes buying convenient, with fast, efficient and courteous self-service. DDR’s earnings stink. Revenues and earnings are falling. And the board may cut its dividend. Ditto with many other REITs.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Theater Groups in South Florida Receive Grant Funding for Shakespeare Remake

The funds will allow a modern-day generational comedy take on Shakespeare’s Hamlet to be performed in Broward and Miami-Dade counties.

Build With Us @ Suffolk’s Business Accelerator Program Honors Minority Graduates

The company is one of the largest contractors in Florida.

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

Other Posts

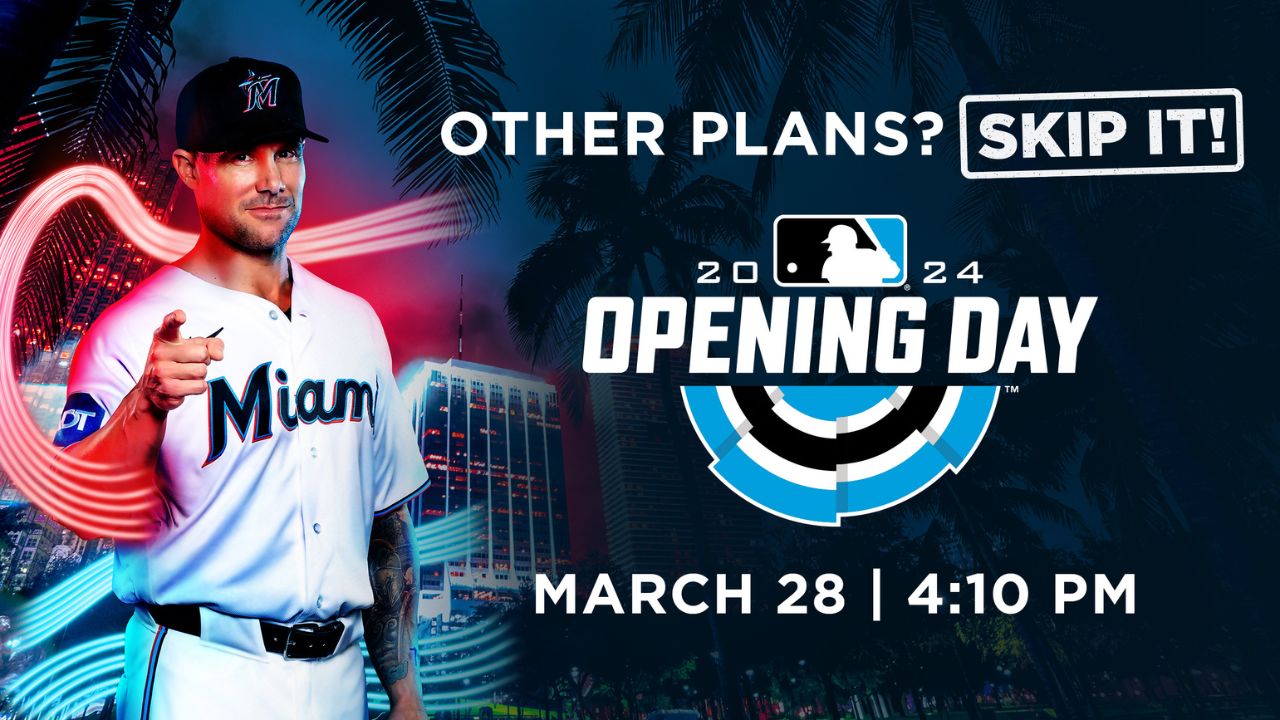

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.