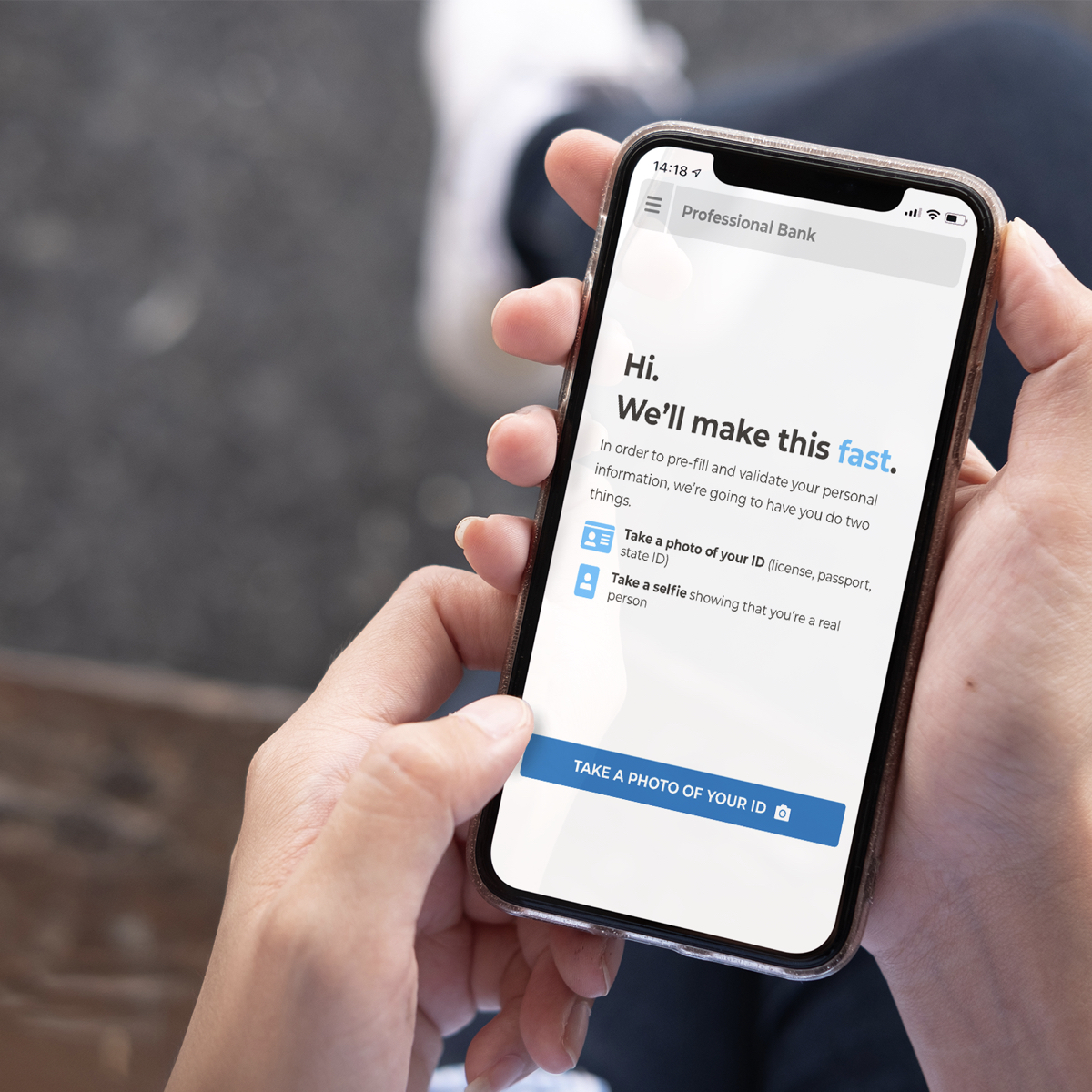

As more consumers turn to online services due to the pandemic, Professional Bank in Miami recently launched a proprietary product to ease the process of starting a bank account. Individuals can use their mobile devices to open a personal checking account online in about three minutes while remaining connected with their personal banker to keep human interaction an essential part of the process.

As more consumers turn to online services due to the pandemic, Professional Bank in Miami recently launched a proprietary product to ease the process of starting a bank account. Individuals can use their mobile devices to open a personal checking account online in about three minutes while remaining connected with their personal banker to keep human interaction an essential part of the process.

“About 40% of banks allow people to complete an account application using a mobile device,” says Daniel R. Sheehan (pictured), Chairman & CEO of Professional Bank. “As a part of our focus with high-touch concierge service, we are leveraging technology to provide a faster, convenient service to expand the human-to-human interaction using the most popular devices. COVID-19 accelerated market adoption that we were already working on to address.”

Sheehan says that most banks require up to 50 pieces of information to establish an account, but the new software aims to cut down on vast amounts of paperwork.

“We’re functionally accomplishing the same with just a few clicks and use of a mobile phone’s camera,” he says.

According to one recent study, 75% of the nation’s banks say it can take five minutes or more to open an account online, with about 30% reporting the digital process can take over 10 minutes. A third of all banks that offer a digital solution still say customers must visit a branch to finalize the process.

“There is room for improvement,” Sheehan says. “We are enabling our clients to move at the relative speed they are used to with other digital product and service providers and avoid the slower pace that comes with additional paper forms, emails and subsequent branch appointments to sign documents.”

Professional Bank’s online account opening only requires a mobile device with photo capabilities, a driver’s license and a minimum of $25 to fund the new account. The bank then integrates a human element by connecting the new account holder to their private banker.

“Right there, on a phone or tablet, our new client is introduced to a member of our private banking team,” Sheehan says. “It’s a further enhancement of our philosophy around client experience.”

Professional Bank’s Digital Innovation Center in Cleveland, which is tasked with leveraging technology to enhance the client experience, developed the online account opening system when it couldn’t find an acceptable solution in the market. Professional Holding Corp. (NASDAQ: PFHD) is the financial holding company for Professional Bank, a Florida state-chartered bank established in 2008.

“We took a look at the entire process of becoming a Professional Bank client and determined it could be improved,” says EVP/Chief Information Officer Ryan Gorney. “Just like we tailor products and services to a particular client, our new system allows us to tailor the application process seamlessly. We get the information we need in a safe and secure way all while prioritizing the human relationship. We don’t want to use technology to replace person-to-person contact, but instead enhance it. That is our goal and what I think makes our system different from competitors. It is built by bankers, for bankers.”