Visit the websites for Florida’s gubernatorial candidates and it is quickly clear that there’s a different stance on the state’s corporate income tax.

Republican Ron DeSantis says succinctly that his goal is to “maintain Florida’s status as a low tax state by opposing tax increases and supporting a constitutional amendment requiring a supermajority vote in the Legislature to raise taxes.” Although he doesn’t mention corporate taxes specifically, it seems clear that he wouldn’t raise them because he says he would stick with the direction set by Gov. Rick Scott.

Democrat Andrew Gillum has a plan that would raise the state’s corporate tax rate from 5.5 percent to 7.75 percent as part of his “Fair Share for Florida’s Future,” a $1 billion plan to invest in job training and education.

Gillum notes that around 90 percent of corporations in Florida pay no corporate income tax and Florida’s 5.5 percent rate is below the neighboring states of Alabama (6.5 percent) and Georgia (6 percent). Here’s how Gillum says proceeds from his plan would break down:

- At least $100 million in public school construction in the PECO (Public Education Capital Outlay) Fund

- At least $400 million in pay raises for public school teachers with minimum salaries of $50,000 a year

- At least $250 million in early childhood education programs

- At least $100 million in SHOP 2.0/Vocational Training, including higher education extension courses for adults and expanded technology classes in high schools

The candidates’ stances might provide a tough choice for some business leaders. On one hand, Florida’s low taxes are seen as a key economic advantage, especially in luring companies from high-tax northeastern states. On the other hand, business leaders often talk about the need to improve education and thereby the quality of the workforce.

One of the big advantages of locating a small business in Florida is paying less in taxes than perhaps anywhere else in the United States, according to the website Investopedia.

“This is because the only businesses that pay state income taxes in Florida are traditional corporations, or C corporations. While small businesses sometimes later convert to C corporations once their growth reaches a certain level, very few small businesses just starting out are traditional corporations; most are S corporations, limited liability companies (LLCs), partnerships or sole proprietorships.”

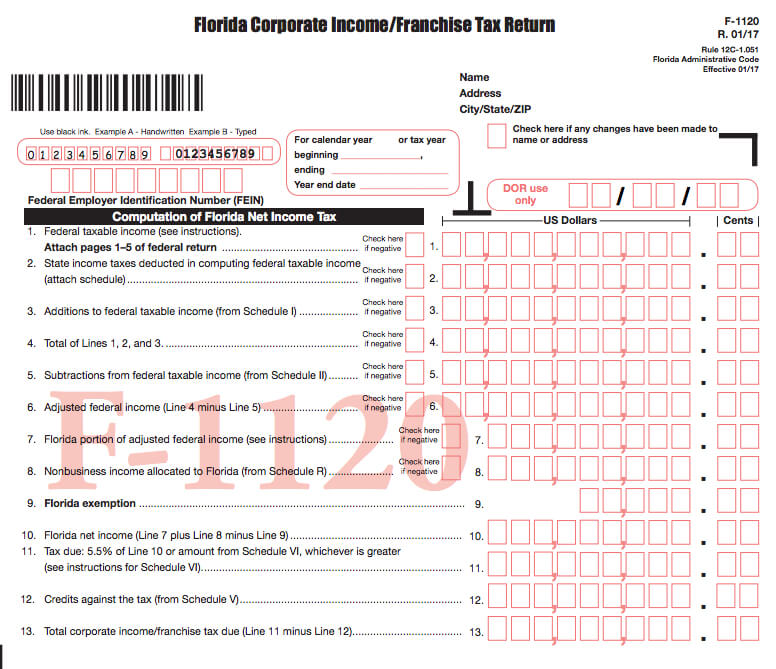

The Florida Department of Revenue notes that there is a $50,000 exemption on Florida’s corporate income tax. There are also several credits available against the corporate income tax. These include credits for paying salaries in Florida, credits for paying other taxes or assessments, and credits for making certain types of investments in Florida.

Both candidates have additional background when it comes to their approaches to taxes.

As a Congressman, DeSantis co-sponsored the Fair Tax bill, which proposed introducing a 23 percent federal sales tax, but it would eliminate federal income, estate, payroll and gift taxes, Politifact.com reports.

Eliminating state personal income taxes is a non-issue in Florida because there is no personal income tax. Florida also doesn’t have an estate tax and the intangibles tax was repealed in 2007.

Gillum’s website says, “He led Tallahassee’s successful push to become one of the only cities in Florida to eliminate the local business tax, saving businesses over $2 million per year, and inserted over $5 million back into local businesses through a utility rebate program.”

The tax in question was for business licenses, which was repealed in 2016. “The business tax is on average $119 for local businesses and $303 for non-local businesses. It will affect about 12,000 businesses across the city, and save a total of nearly $2 million,” television station WCTV reported.