After opening locations in Denver, Aspen and Montecito, interior designer Margarita Bravo has finally landed in Miami, which couldn’t be a better fit, as Bravo, with her modern Spanish aesthetic,

Designer Margarita Bravo Debuts in Miami

After opening locations in Denver, Aspen and Montecito, interior designer Margarita Bravo has finally landed in Miami, which couldn’t be a better fit, as Bravo, with her modern Spanish aesthetic,

Ed Morse Automotive Group recently acquired Cowboy Harley-Davidson’s three locations in Austin, Beaumont and San Antonio, Texas. The acquisition also includes the Harley-Davidson retail store at River Walk in San

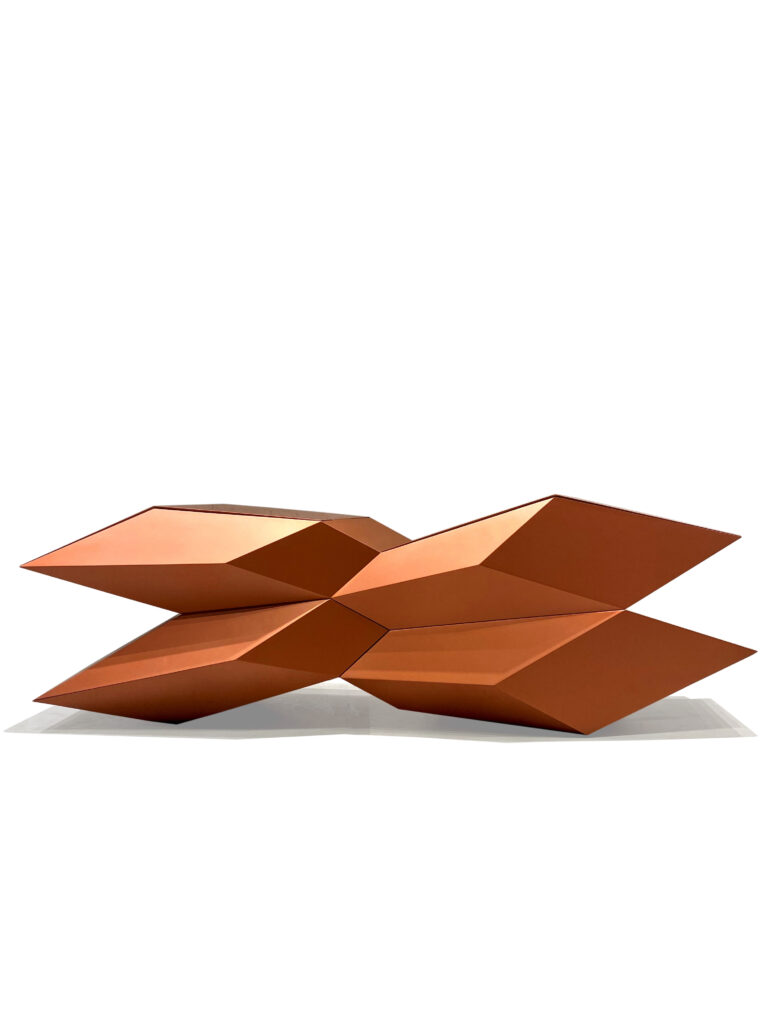

Nicolas Roche, collections director of the iconic Parisian furniture brand that bears his name, can be forgiven, in the announcement of the company’s newest showroom and latest collection, for calling

Berkadia secured the construction financing for the redevelopment of Wyncatcher to be converted to a boutique office property with retail space and a rooftop terrace. The former warehouse, located in Miami’s

Sports & Social, a national dining and entertainment concept, will be the latest tenant to open at Miami Worldcenter, a $4 billion, 27-acre mixed-use development in Downtown Miami. Other confirmed

Would you like your business spotlighted in front of South Florida’s up-and-coming business professionals? SFBW’s Up and Comer Awards provide the perfect opportunity to showcase your business to the area’s

Manor at Miramar recently finished the topping off of the mixed-use development in Miramar. The eight-story development, located at 1 Main Street, will offer 393 residential units, a 655-space parking

NAIOP South Florida, a Commercial Real Estate Development Organization, recently hosted its annual NAIOP South Florida Economic Development Panel at the Tower Club in Fort Lauderdale. Attendees included industry leaders

As the South Florida skyline continually adds high-rise developments, the new residential buildings take advantage of the bird’s-eye viewing with a luxurious perk — coveted rooftop pools with cafes, juice

From the neon sign that everyone who passes through Miami Beach’s South of Fifth points out to a hidden culinary membership club in the Miami Design District. That’s the leap