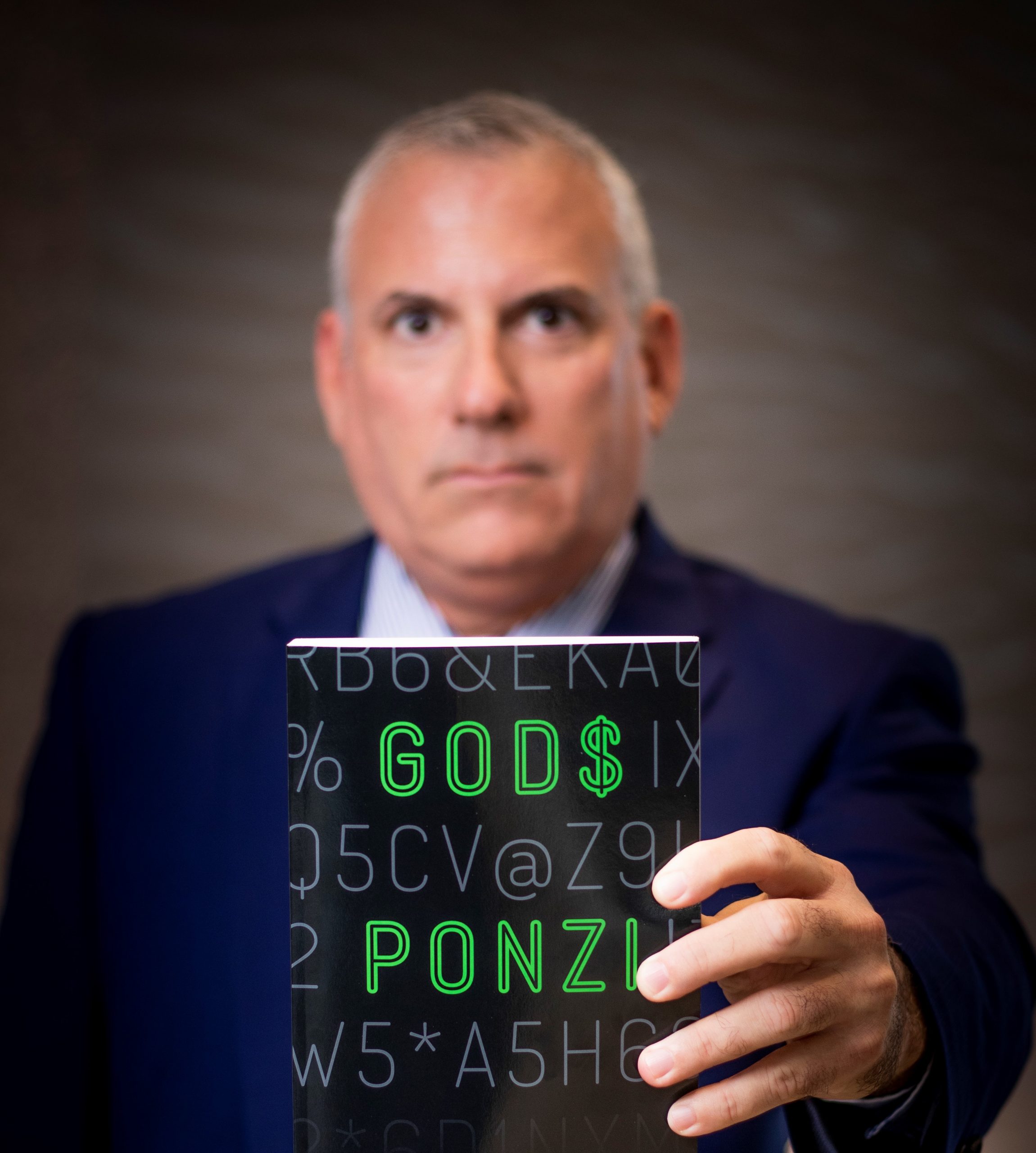

In God’s Ponzi, Gregory Portent needs $42 million by the end of the week to exact his revenge and prove, among other things, that “lawyers aren’t heroes.” The elaborate Ponzi scheme he’s running, a seemingly foolproof enterprise driven by artificial intelligence, has been blindsided by an unforeseen black swan event. “If I can’t fix this … bolt of lightning in the next few days,” Portent says, “I could end up dead—and I’ll be leaving behind the lives left in shambles of the people I care about.”

Though Robert Buschel isn’t trying to rewrite a sordid slice of Broward County history with his latest novel, the fictional journey on which his main character embarks isn’t without its art-imitating-life vignettes.

The renowned trial attorney, a partner at Fort Lauderdale-based Buschel & Gibbons for the past 12 years, was a lawyer at Rothstein Rosenfeldt Adler in late October 2009 when its managing shareholder and CEO Scott Rothstein fled to Morocco and sent his law partners a Saturday suicide text on Halloween. By that Monday, the reason why was all over the news.

Rothstein, known for his extravagant lifestyle, had been running what was later determined to be a $1.4 billion Ponzi scheme (one of the largest in history) involving the sale of fraudulent settlement agreements. Rothstein ultimately returned to Fort Lauderdale and turned himself in on Dec. 1, 2009. He later pleaded guilty to orchestrating the scheme and a received a 50-year federal prison sentence. Nearly 30 other individuals caught in various tentacles of the law firm’s illegal dealings were arrested and/or convicted—including Rothstein’s wife at the time, Kim, who served 18 months in prison.

Buschel, who was never accused of misconduct, recalls reaching out to his current partner, Eugene Gibbons, relatively new to RRA at the time, during the weekend that all hell broke loose. “Eugene was on a family trip in Tampa,” Buschel says. “He’d been at RRA less than a year. I said, ‘I hate to do this to you, but I’m going to throw a pretty fast pitch, and it’s going to seem like it’s going at your head. Scott Rothstein just took the law firm’s trust account and flew to Morocco. It’s over.’

“I told him that we should think about partnering up and moving forward,” he recalls. “I understood that a lot of people would mistakenly [assume] that everybody at the firm had to be in on it. Most of us, in fact, weren’t. But there was no time to wait around. I wanted to get out in front of it. So, Eugene and I took our shot and started a firm. It’s been a honeymoon ever since.” The same can’t be said for Rothstein, whose attempt at a sentence reduction in 2018 was shot down for violating the terms of his plea deal by lying to authorities and committing more crimes from behind bars.

Buschel looks back at the Rothstein saga—and ties the past to both God’s Ponzi and the present—in this wide-ranging interview with SFBW.

In your preparation for God’s Ponzi, did you end up learning anything about Ponzi schemes that you didn’t already know?

I learned about Ponzi schemes watching [Scott Rothstein] implode. I had to run my fingers through my hair to remove the dust from the fallout. Did I look around after I got out of the rubble? I did. There are a few people you’d talk to, and they would say, “Scott did live the rock star lifestyle.” If you were making a deal with the devil, would you be willing to spend that much time in prison if you had five, six, seven years of living like Scott Rothstein?

I’d ask that question, and it surprised me how many people would make that deal. And I’d think, no, no, no. You’re not putting everything on the table. Here’s what you’re not adding to the equation: You have to screw everyone who’s ever been nice to you.

It’s not a matter of, OK, I’ll live like a rock star for seven years, then I’ll go to prison. Scott didn’t know when it was going to end. Imagine the immense stress of keeping that Ponzi balloon in the air? Every day, it’s like, “How am I going to raise another $1 million before the end of the month?” That’s not fun. Along the way, you have to be willing to hurt anyone who’s ever been nice to you—down to the clerk that you hired to make your copies. That’s what I learned. Most people can’t wrap their head around how bad that is. It’s like when Joe Pesci plays these fearsome guys in a movie. Even though he’s like [5-foot-4], his character is willing to take a bottle and crack it over somebody’s head. What are you willing to do? Are you willing to steal that old lady’s money? Are you willing to knock her to the ground and take her purse? That’s the difference.

On that note, take us back to October 2009. By that time, Scott Rothstein’s larger-than-life persona was well-known in Broward County. Did you have any suspicions that something about the firm wasn’t right?

When I joined the firm in 2006 there were only 20 lawyers. It was a bunch of guys who seemed like they had a nice vision to do some interesting work and grow the business. But those last 18 months, Rothstein went supersonic. The firm was up to 70 lawyers [with offices throughout Florida, in New York, and even an affiliate office in Panama]. In any larger law firm, you don’t always know what everyone else is doing. But every once in a while, you’d hear someone go, “He’s got to be up to something.”

What was the explanation for the expansion?

It was Scott’s dream to have a big law firm. He’d say that he was investing a lot of money in the firm, and that he was doing it with his own money; he had investments in a hedge fund, and they were all doing “very well.” At the time, putting a couple of million in the firm and trying to grow it seemed like a perfectly fine explanation. Of course, I didn’t have access to the books.

How did you find out that Rothstein was in trouble?

I went to the office on a Saturday. On the way into the building I bumped into Marc Nurik [a lawyer at RRA]. He said, “I’m resigning from the firm. You’re going to learn what’s happening. Some stuff with Scott is going down. And I’m going to represent him.” [Nurik became Rothstein’s criminal defense attorney]. Marc told me to keep my head on a swivel. The news broke soon after.

On that Monday, I went to work. It’s been more than a decade, so some of this is [hazy]. But at one point there was a firm meeting where [RRA partner] Stuart Rosenfeldt gave us an update. [The next day], the FBI and [U.S. Treasury] agents served the warrant to search our offices. I do criminal defense work, so I knew one of the agents. She was very pleasant. I was escorted to my office so I could get [some personal things]. The agents were copying everything off our computers, searching for evidence. As far as the size and the scope of [the scheme], I was reading about the case, the same as everyone else, in the newspaper.

If you were smart, you weren’t talking to anyone at the firm. I didn’t know who was going to get indicted. I didn’t know if Stuart Rosenfeldt was going to be indicted [he pleaded guilty in 2014 to criminal conspiracy and was sentenced to 33 months in prison; Rosenfeldt died in December 2021]. I was shocked when Steve Lippman was indicted [the RRA attorney was sentenced in 2012 to three years in prison for, among other violations, defrauding the IRS by failing to report reimbursements for personal expenses from law firm funds as taxable income].

There were certain people who surprised me. Some who didn’t surprise me. And certain people who didn’t get indicted who I thought, “Hmm. Good for them.” But I would never discuss it out loud. You don’t want to start trading information because you never know who might be wearing a wire. Or who’s full of crap. I did not want to be a witness. I had to worry about starting a new law firm.

Did you have to hire a lawyer until it could be determined you weren’t involved?

The U.S. attorney’s office was calling me, asking for people’s phone numbers. And I actually had a case with them involving something else. Their behavior toward me was very collegial. If they suspected me of something, it wouldn’t have been.

Looking back, do you have any sense of why Rothstein turned himself in, instead of disappearing to a country, like Morocco, with no extradition to the U.S.?

In God’s Ponzi, Gregory Portent speculates for about a half page as to why Rothstein did what he did—including this idea that, if you leave the U.S., you can’t care about anything you’re leaving behind. He suggests that there were people in Morocco who explained to Rothstein that you can’t just leave the U.S. and not come back. Bad things will happen to people that you care about. Morocco may have its wealth, but this isn’t a first-world country. They’re not going to guarantee your safety just because you dropped a little cash at the maître d’s desk. If people are looking for you, and there’s serious money involved, Morocco isn’t your hideout.

That’s the fun part of [being an author]. Personally, I never heard anything like this [regarding Rothstein]. But my character can speculate. I’m sure Rothstein also thought he’d get like 30 years, that he’d be a cooperating witness, and that he’d ultimately do half that time. It’s not a bad plan. Except he was sentenced to 50 years—and then he lied to the government [about helping then-wife, Kim, hide jewelry from court and bankruptcy officials; Kim spent 18 months in prison for her part in concealing jewelry assets worth more than $1 million from the government]. At that point, the prosecutors had no use for him. He was worthless as a witness.

To be clear, God’s Ponzi is not a fictionalized version of the Scott Rothstein story. But you do address themes that have ties to the case. What’s an example?

There’s a main character, but there’s a team behind him. Nobody switched sides. Nobody betrayed each other. In fact, as the plot progresses, people get in trouble when they don’t reach out for help from the team. With all these TV shows like Billions and Succession, and even some reality shows, everybody is in it for themselves. Alliances form and break. It’s exhausting trying to keep up. When does the loyalty kick in? That was Scott’s biggest offense. And that’s some of what I wanted to tackle in the book. What have we become? If someone can give you a straighter path to reach the next level of the stratosphere, are you going to dump all the people who’ve supported you? Your family and friends? That was Rothstein’s biggest sin. He betrayed people who were always looking to help him. That includes the good lawyers who knew nothing about what he was doing.

Is any aspect of the plot your attempt to rewrite a slice of the Rothstein history?

Definitely not. Gregory Portent is doing a Ponzi scheme for a reason other than to make money. The reason why he’s likeable is that the readers soon understand that he’s doing the Ponzi scheme to get revenge on evil lawyers, evil doers. He’s not looking to make a dollar; he’s trying to show who the real bad guys are. He’s demonstrating that he can lure anyone with an evil heart into his Ponzi scheme.

Several lawyers, like John Grisham, have produced works of fiction. What is it about your profession that lends itself to that transition?

Lawyers, particularly trial lawyers, are storytellers. If you have that ability, then you have some tools to write a novel. Plus, the real world, especially now, is full of stories that we can hardly believe. Is it fake, or is it Florida? I can take you to the top of the Bank of America building on Las Olas Boulevard and point out where crimes took place involving different Ponzi schemes, not just Scott Rothstein’s.

Speaking of which, according to a 2020 Federal Trade Commission report, Miami/Fort Lauderdale ranks fifth in the U.S. for fraud reports (per 100,000 population). Six of the top 11 metropolitan areas on the list are in Florida. Why is Florida the fraud capital?

For one thing, you can reinvent yourself here. Why is everybody from New York and all these other places thrilled to buy property here after COVID? It’s because you get so much for your money. And guess what? No state income tax. But wait! Homestead exemption? You mean if I buy a big giant home, you can’t sue me? And if you do sue me, I get to stay in my house? So, you can bury a lot of money in your house. Also, it’s the good weather.

What are some red flags that people should keep in mind when it comes to enticing investments and the potential for fraud?

It’s a simple concept, but it can be applied to almost any type of business. Is this too good to be true? I can get 300% return on my money in 90 days? No. Nobody does. But that’s often counterbalanced against the fear of missing out. Also, think about, “Why am I so lucky” or “Why am I so special” to be receiving this offer. How did that happen? If you can’t answer that question with complete clarity, you need to think very hard about any investment opportunity.