Dear Mr. Berko: I think it was in August that you wrote a short comment about Accelerate Diagnostics. At the time, it was trading at $19. I’ve been a nurse for nearly 30 years, so I was impressed when I read about Accelerate’s platform for the quick diagnosis of infectious pathogens and nosocomial infections. I didn’t buy the stock, because my stockbroker thinks you’re a “smart a–” and has a low opinion of Accelerate. He never likes anything you recommend and won’t read your column. He also said Accelerate is too speculative for me, though 200 shares would be less 1 percent of the value of my individual retirement account.

Two doctors my husband and I see socially outside the hospital know about Accelerate. They like the concept, but each has reminded me of the startup called Theranos. Theranos offered comprehensive blood test results using a blood sample from a finger prick, costing one-fourth of the usual lab cost. Both of these doctors lost a bundle as Theranos insiders. The news reports said Theranos was faking the test results. My lawyer husband says it’s out of business, though our doctor friends say it’s still in business. — JS, Oklahoma City

Dear JS: For all intents and purposes, Theranos is dead as a rock. Founded by the brilliant and beautiful Elizabeth Holmes and financed with hundreds of millions of dollars’ worth of feverish and frenetic venture capital, Theranos is now all but kaput. This was a highly exciting concept, and many in the medical community went bonkers over charming Elizabeth, who left Stanford to become a capitalist. But in July 2016, federal regulators locked the doors, claiming that the test results were fiddled, and Theranos quickly became a zombie company. Your husband is right. Tell your doctor friends that the problem with zombies is they don’t know they are zombies.

I’ve written about some boopers during the 40 years this column has been published in your paper. I’ve also called stockbrokers lots of names over those years (and I believe that what’s suitable for the goose is suitable for the gander). However, your broker may be right as rain and sunshine. Accelerate Diagnostics (AXDX-$19.88) is an obscene speculation with no earnings in sight. The company uses a proprietary technology to eliminate time-consuming preparation steps prior to blood testing. It also forgoes the intense, time-consuming delays from microbiology labs; traditional culture-based tests often take two to three days to complete. So “using a proprietary phenotypic and molecular detection system, Accelerate significantly reduces the time that clinicians must wait for the quantitative, antimicrobial susceptibility results necessary for optimal antibiotic selection, dosing and infusion therapy.” That’s a mouthful. And if you’ve got that in your head, you’ve got it in a !

nutshell. Frankly, I don’t know what all of this means, but two docs I know tell me AXDX “could be revolutionary.” However, the operative words there are “could be.”

AXDX, a Tucson, Arizona-based company, has had no revenues to speak of in the past decade. This year, rumor suggests that AXDX could report revenues of $850,000, though there probably won’t be any profits. AXDX lost $15 million in 2013, $30 million in 2014 and $45 million in 2015. Losses for 2016 have not been posted yet, but the guesses are that AXDX lost between $55 million and $81 million. So there have got to be some very deep-pocketed investors who ardently believe they’ll get their investment back plus a lot more. Vanguard, Fidelity, William Blair, Loomis Sayles, BlackRock, State Street, J.P. Morgan and UBS must agree, because together, they and a few others own 50 percent of the company.

A purchase of 200 shares might be a reasonable risk for you. J.P. Morgan is unabashedly bullish, and other brokerages also believe that AXDX has substantial appreciation potential in the next dozen months. I think I agree. But don’t antagonize your broker, who is probably a good guy. Tell him that you’ll speculate by buying just 100 shares because it’s possible that he is right.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

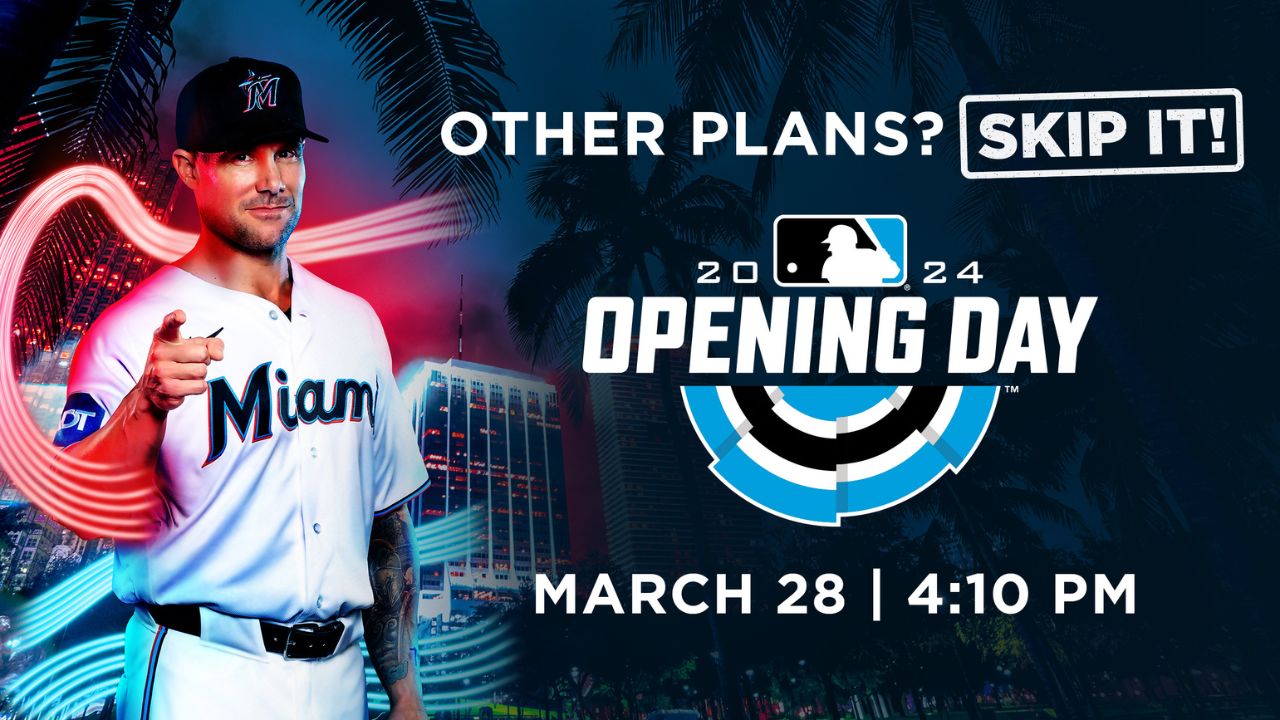

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was