Dear Mr. Berko: My wife and I are in our early 70s, are retired from good jobs and have no children. Our joint account (enclosed) has $1.23 million, and our two identical individual retirement accounts are worth $549,000 each. We own our home, which is worth about $170,000, free and clear. Our car is paid for, and we have no debts. We are very careful about spending on things we don’t need and are very conservative in the market, as you can see from the investments in our three accounts.

We’re very concerned that the stock market is going to crash. We attended a steak-dinner sales pitch and were impressed with the annuity of an A-rated insurance company that has been in business for almost 100 years. There would be no commissions or annual fees, and we could take a 10 percent withdrawal every year. The annuity is invested in mutual funds; if the stock market were to go up, our investment would go up, but if the stock market went down, our investment would stay the same. For the past 20 years, the mutual funds in this annuity have averaged between 3 and 9 percent a year. And the insurance company would give us a bonus of 10 percent if we invested $500,000 and 15 percent if we invested $1.23 million. It sounds as if we couldn’t possibly lose and we could make a 15 percent profit immediately if we turned our $1.23 million joint account into this annuity. I don’t exactly understand how this annuity works, and your advice on what to do would be appreciated. I’m !

afraid the market will have a huge correction, and I think the annuity would protect us. Should I invest $1.23 million for safety? — TT, Springfield, Ill.

Dear TT: This salesman wants to take you to the dry cleaners, the carpet cleaners and the sewage cleaners. That’s common in cities such as Springfield; the closer you are to a state capitol the more the morals of annuity salesmen resemble those of the legislators inside. My advice is to stay the course with the excellent stock selections in your accounts.

But for your information, I’ll ask you six questions about the annuity, the name of which you haven’t shared with me. Then you must pose the same questions to your salesman.

1) Seeing as there would be no commission if you purchased a $1.23 million annuity, how would the salesman be paid? Does he work for the Salvation Navy or the Red Cross? Did the Red Cross pay for your steak dinner?

2) If there are no annual costs with this annuity, who pays the mutual fund managers to make the buying and selling decisions in the annuity’s subaccounts? Who pays the salaries of the bookkeepers and clerks who collate, print, prepare and mail the quarterly statements investors receive? Who pays for the office rent, the utilities, the postage and the phones?

3) A 15 percent bonus would be a swell amount for you — about $185,000. Now reach way down deep into that part of your soul where you know the truth exists and ask: “Where would that $185,000 bonus come from?” “Why am I so lucky to be gifted this bonus right out of the blue?”

4) If the annuity earns between 3 and 9 percent annually and you took a 10 percent withdrawal annually, how long would it take to reduce $1.23 million (plus the $185,000 bonus) to zero?

5) What would your tax obligations be on this money?

6) If the stock market were to go up in value, the annuity might rise in value. But if the market were to fall, how would it be possible for the annuity not to fall in value with the market?

Ask the salesman to mail his answers to you on his letterhead stationery. I’ll betcha 10 bucks he won’t.

Too many annuity salesmen are articulate incompetents who’d steal the dimes off their dead mothers’ eyes. They prey on the naivete of unsophisticated investors and speak in half-truths. They have no more conscience than a fox in a poultry farm, and most are employed by the banks where you redeem your certificates of deposit and deposit your checks. Don’t be shy about conferring with your stockbroker at UBS. I’m sure he will agree.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2016 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

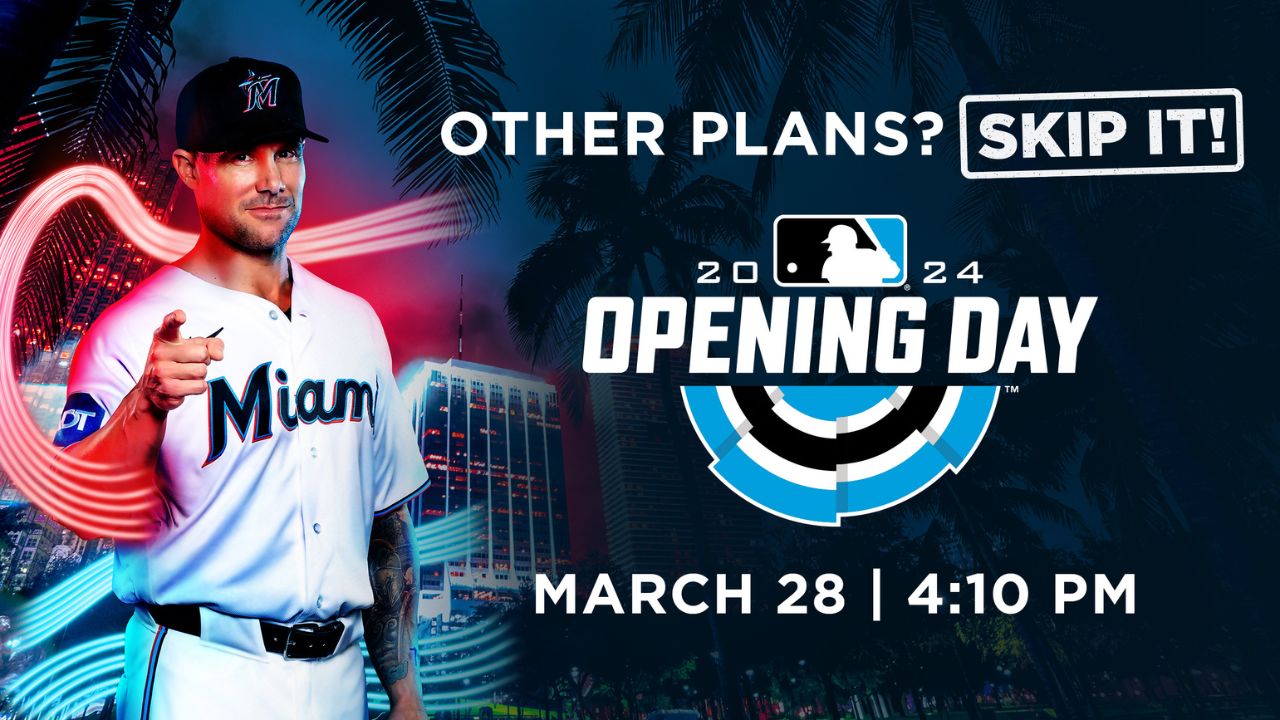

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was