Dear Mr. Berko: How did Standard & Poor’s and Moody’s Investors Service cause our financial crisis? And which of the two firms is better at analyzing stocks and bonds? Also, what are cat bonds? — BD, Charlotte, N.C.

Dear BD: Thank you for your beautiful and artistically penned three-page letter on that richly textured linen stationery, which must have cost you $5 a page. Your penmanship is masterful. That’s a lost art. However, you could have saved $10 by distilling your letter to just the three questions above.

Up until the mid-1970s, the big three bond credit rating agencies — S&P, Moody’s and Fitch Ratings — were paid for their analyses by investors who wanted impartial opinions of a corporation’s or municipality’s creditworthiness. For decades, their work was quite satisfactory and highly regarded. However, the big three began receiving payments from underwriters, including firms that sell these securities to investors, of bonds. So recognizing human nature — especially man’s insatiable greed — this led to accusations that underwriters were shopping for the best rating to attract investors. For instance, Goldman Sachs, which might be underwriting bonds for a Harley-Davidson cologne plant, might say to Standard & Poor’s, “Here’s a hundred grand on top of your normal fee if you assign this bond a rating of AA” — even though it stinks and honestly should be rated B.

To attract more investors, Moody’s, Fitch and S&P readily, though surreptitiously, played this rating game with Merrill Lynch, UBS, Citigroup, Wells Fargo et al. and delivered favorable ratings for enhanced fees. This arrangement has been cited as one of the primary causes of the subprime mortgage crisis, which began in 2007. I well remember when mortgage-backed securities and collateralized debt obligations were given investment-grade ratings by the credit agencies, which encouraged pension funds, investment banks and insurers to invest heavily in these securities. And I well remember how the market value of all these securities crashed and burned because of defaults and fear of defaults. It was a massive mess.

I believe that Moody’s ratings are superior to those of Standard & Poor’s. Historically, municipal and corporate investment-grade bonds ranked by Standard & Poor’s have a failure rate that is three times greater than IG bonds ranked by Moody’s. And non-IG bonds ranked by Standard & Poor’s have nearly twice the rate of default as non-IG bonds ranked by Moody’s.

Catastrophe, or cat, bonds are risk-linked securities that transfer a specifically identified risk from the sponsor of the bond to the buyer of the bond. Cat bonds are debt instruments, usually insurance-linked and issued by property and casualty companies, intended to raise money in case of a hurricane or earthquake. The structure of cat bonds provides for a payout to the insurer if a defined event of a certain magnitude occurs. This lowers the insurer’s reinsurance costs, providing more capital for an insurer to underwrite more insurance. Cat bonds are not closely linked to the stock market or economic conditions, but they usually offer a higher rate of interest compared with alternative investments. Cats reduce the risk to insurers by transferring this risk to investors, who can lose all or a portion of their cat investments. However, investors’ risk is mitigated by the usually short maturities of three to five years. In the 21-year history of catastrophe bonds, there have been only 10 instances (as of November) that have resulted in losses to investors. Hurricane Matthew, which trashed the East Coast in October, may trigger the 11th instance of loss. Those cat bond owners may receive only a partial return of their equity when all claims — including the ridiculous lawyer games, mishmash and legal posturing — are settled.

There is nearly $80 billion in cat bonds outstanding, primarily issued by insurance companies to lower hurricane risks in the U.S. Several billion in cat bonds was issued to cover such events as Japanese typhoons, earthquakes, hurricanes in the Caribbean and health claim payouts. These bonds are purchased mainly by pension funds, and their numbers are expected to double in the coming five years.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

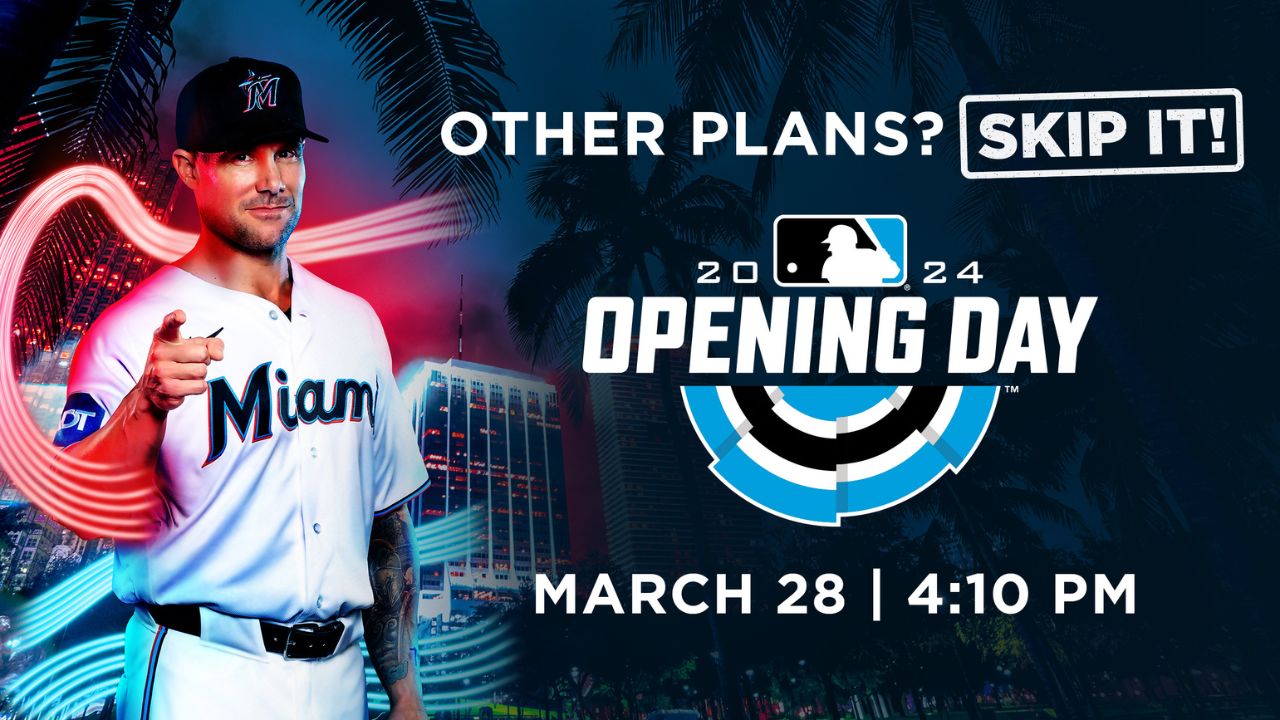

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was