Dear Mr. Berko: I’m a 71-year-old widow. I’m seeking safe, high income, and I can afford some modest risk. My husband passed away in 2009, and I’ve done a fairly good job managing our $637,000 portfolio. Last year, I found a new young stockbroker who seems to have a good head on his shoulders. I have about $21,000 to invest, and he recommends 300 shares of Blackstone Mortgage Trust and 200 shares of Dominion Energy, which you recommended last month. Please tell me what you think of the former stock. I know your thoughts on Dominion.

My biggest problem is my husband’s old broker, who works for another firm. He calls me once a week to try to bring the account back and insists the market is headed for a crash in a few years. He is a nice man, but he’s one of these men who think women are inferior and can’t do things for themselves. How can I stop him from calling me and still be nice to him? — FS, Indianapolis

Dear FS: Call the manager of his firm and tell him that this guy is bothering you. His calls should end as abruptly as a rabbit’s tail. If he continues calling, don’t be nice. Tell him you will file a harassment suit. By the way, I call my wife “my better three-quarters,” and she is.

You were lucky to find a good young man who still recommends common stocks rather than that proprietary junk sold by most new brokers. Meanwhile, I doubt the market will crash in a few years. Rather, I think it could run to 30,000 by the time you’re 80. So the brokerage industry is on a hiring spree. And the newly minted brokers draining from the training programs of Merrill Lynch, UBS, Edward Jones and Ameriprise are worth about a dime a dozen. For the past decade, these NMBs have evolved into corporate cyborgs — programmed to sell annuities, mutual funds, private limited partnerships and high-commission proprietary products. Most of these NMBs think a blue chip is worth $10 in a poker game, an “interest rate” is a Nielsen rating and common stocks are animals that belong on a farm.

FS, give your new broker a gold star and a pat on the head, and take him out to the executive dining room at Taco Bell for lunch. Then give him a box of Fanny Farmer chocolates for his spouse. I think that buying 300 shares of Blackstone Mortgage Trust (BXMT-$31) and 200 shares of Dominion Energy (D-$76) makes a lot of sense for a conservative widow who’s 71 years young and seeking high yield with modest safety.

BXMT is a mortgage real estate investment trust that is unlike other mortgage REITs in that investors actually benefit from rising interest rates because of the floating-rate nature of its loan portfolio. BXMT’s conservative strategy invests in a senior loan portfolio that is 100 percent performing and has never had a default. So as rates rise — and you can bet your sweet bippy they will — BXMT’s dividends will rise, too. And that’s the frosting on the cake.

BXMT originates and purchases senior mortgages that are collateralized by properties in the U.S. and Europe. BXMT’s well-diversified portfolio consists of 118 loans, with an average loan size of $120 million, and approximately 85 percent of these loans are issued with floating interest rates. As a result, BXMT’s portfolio is generally dependent on long-term interest rates. And as Libor rates increase, BXMT’s profits are figured to grow by about 3 percent for each Libor rate increase of 1 percent. Today’s one-year Libor rate is 1.68456 percent.

BXMT expects to modestly increase its 2017 income to $325 million, and its 62-cent quarterly dividend yields 8 percent. But if the Federal Reserve raises rates again (it may raise rates twice in 2017), BXMT’s management will also increase the dividend. Wall Street believes that the stock will trade in a narrow range — between $29 and $33 — over the next four years. And the Street believes that in that four-year time frame, there’s a good possibility the current $2.48 dividend will be raised to $2.78, which would be a sweet 8.9 percent yield on today’s purchase price.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

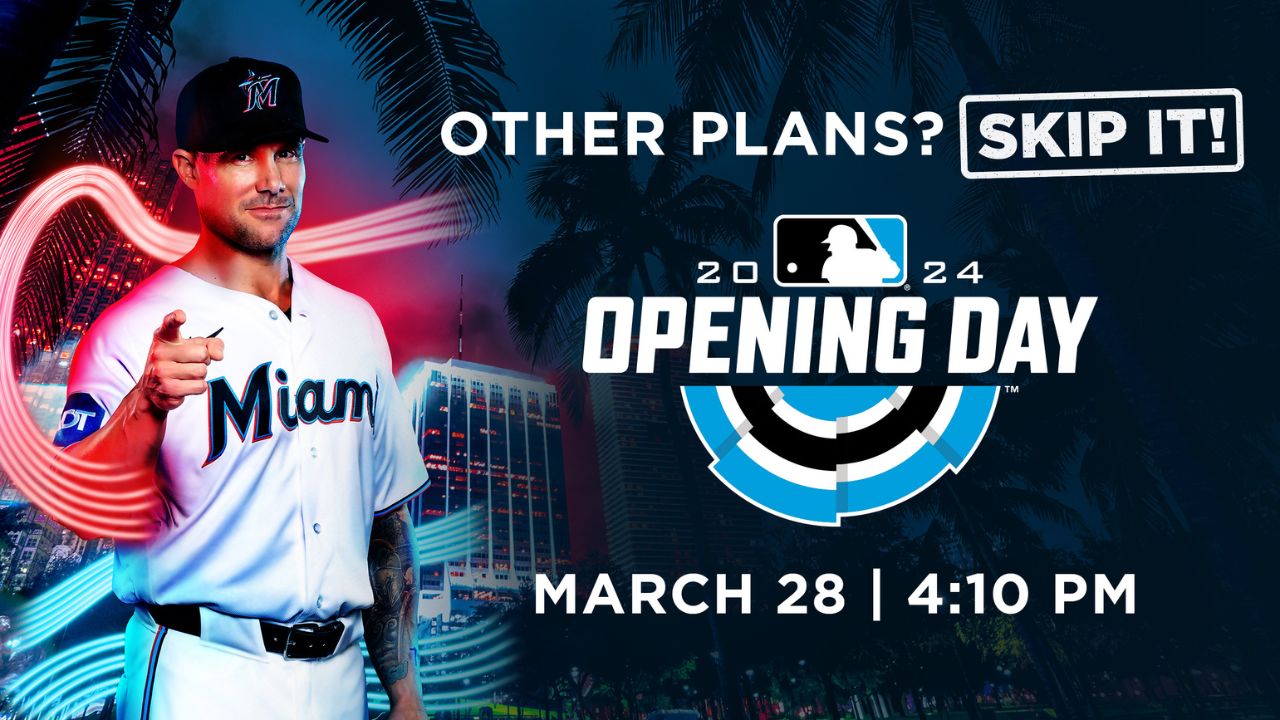

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was