SFBW’s All-Star Economic Review and Outlook panel reported a strong 2019 and confidence in 2020 even as they were casting a wary eye on the emerging corona virus. Low interest rates are a big plus, but finding labor and large plots of land are a challenge. Apartments, industrial space, mixed-use developments and experiential restaurants and retail are in vogue, but hotel construction might hit a pause.

The panel was sponsored by Amerant Bank and held at Junior Achievement of South Florida in Coconut Creek. Panelists included some of the largest businesses and employers in South Florida.

Here are highlights of the discussion moderated by SFBW Editor-in-Chief Kevin Gale. They have been edited for brevity and clarity.

Anita Byer, CEO of Setnor Byer Insurance & Risk

My clients actually did well, last year. The strong stayed strong and got a little bit stronger. The weak don’t stay in the business. There was no opportunity to have a weak business model and you know, prosper. It was a good year, was good for my manufacturing clients. I know we were frightened of the tariffs and what would it do. They passed those costs, 75 percent of my manufacturers, on to the consumer who really didn’t feel it that much. Because of the tax changes, the typical consumer actually had more in their pocket.

We do have obviously—not to be political—a hospitable government right now for business and I’m a big advocate of that. I don’t like restrictions.

Frank Weed, vice president of Development and Construction, Penn-Florida Cos.

We are about to launch an 80-acre project north of the Boca Raton Executive Airport called University Village. [The website lists 829 residential units, including lofts, apartments, and assisted living facilities; a 183-room hotel, 70,000 square feet of office space and 130,000 square feet of residential ground floor retail.]

We just finished the Jack Nicklaus golf course, Via Mizner Golf & City Club, which is the old Boca Del Mar Country Club. It’ll be open in about six months. The commercial side is building the Mandarin Oriental Hotel Boca Raton and the Mandarin Oriental condominiums. [This is the first Mandarin Oriental residential project in the country, and the overall project, with 92 condos that started at $2 million, is $1 billion.]

Sameer Nair, VP of Hotel Acquisitions at Kolter Hospitality

We’re a division within Kolter Group, a real estate investment and development company. Business was good, and occupancy levels are high in our hotels. We focus mainly on select-service hotels in Florida. There was a bit of a slowdown in hospitality, which is usually a leading indicator. REVPAR [revenue per available room] was up just over 3 percent in 2017 and just under 3 percent in 2018. In 2019, we actually ended up just under 1 percent. Some of the things that we’re cognizant of is labor costs continuing to rise along with third-party fees. Revenue is becoming harder to maintain and grow.

From a supply [of new hotels] perspective, it’s very local. On the demand side, it seems to be consistent. Occupancy levels are high throughout the country.

Beverly Raphael Altman, president and CEO of RCC Associates

We are a general contracting firm. Business went very well this past year. We experienced some of the best results that we have seen, due in large part to the economy and less fear of moving forward with signing leases.

We specialize in building high-end restaurants, retail, bars, luxury jewelry, theaters and renovating boutique hotels. The last three, four years have been phenomenal. In 2021, RCC will be celebrating its 50th anniversary. This past year we also have done successful joint ventures. One of them is Parker Playhouse.

Restaurants have been holding very strong. We are one of the few contractors building food halls and food courts and have the most experience. We’ve completed four of those and two of them have been rated as the top two in the state. We don’t see a slow down for us.

Matt Katz, managing member, Katz Barron

2019 was a very strong year from a revenue and profit standpoint. When we have good years, our clients are obviously having a good year. We focus on construction litigation, real estate and corporate transactional work. We’re strong across all those areas. We’re cautiously optimistic that continues going forward. We’ve got the uncertainty coming up with the election and anticipate the market probably will get a little choppy and that will probably reflect on private investing, people buying and selling companies as well as investing in real estate.

Rex Kirby, president of Verdex Construction

We started up in 2015 and grew very rapidly for those first four years. Sometimes when you’re growing, you kind of need to take like a little landing, so we were fairly flat between 2018 and 2019 by choice. One of the things we saw was, a couple of jobs, due to financing or permitting, it took them a lot longer to get into the ground, but we had a great year. We started our first project over on the west coast, in Tampa. We’re headquartered in Palm Beach County, so almost all of our work is in Palm Beach County, but we work in Miami-Dade and Broward and our market share is increasing.

We are still seeing an enormous amount of apartment construction. In 2019, part of our strategy was, let’s make sure we’re not just riding the apartment wave. And so we worked really hard on getting into the public sector, which we did get our first construction management services contract in in the public sector. We’ve talked with the planners and the real estate attorneys and they say the pipeline is still very full for apartments going into 2021. We’ll take another pretty good jump in revenue.

Peggy Marker, president of Marker Construction Group

We are a general contractor headquartered in Fort Lauderdale. We’ve been in business 20 years, and I cofounded the company with my husband, Greg. We are 85 percent commercial, 15 percent residential. We do a lot of hospitality work and car dealerships currently and some multifamily. We see a lot of apartments in the pipeline. It seems like the market is very saturated with hotels to the point that it’s going to have to slow down.

Our biggest challenge last year, with 85 percent growth, was managing that growth, trying to keep our quality consistent and being able to have good solid people join a team that needs to deliver to clients.

Gregory Haille, president of Broward College

Broward College has about 63,000 students, which is in the U.S. top 10. We are celebrating our 60-year anniversary, which is fantastic. Our primary role in is really twofold: It’s being sure we get students to transfer to universities, and then it’s also maturing students who are moving directly into the job market. There is the 2.6 percent unemployment rate, so our students have great opportunities.

One question is how we penetrate those communities that don’t have the 2.6 unemployment rates. One thing that we embarked upon this past year was identifying what those communities need that’s not being satisfied. We are introducing the business community to build these communities. It’s been absolutely exceptional. We served over 1,000 residents and had over 100 program certificates issued in the first year. Just one quick anecdote: I introduced myself as the president of Broward College to someone who said, “Oh, I can’t go to college.” He had no idea that that if you go through our automotive program, you can earn $50,000 to $60,000 a year in no time.

Jarett Levan, president of BBX Capital Corp.

We’re a publicly traded diversified holding company. We have four segments: Bluegreen Vacations, BBX Sweet Holdings, a real estate division and a company called Renin, which is a home hardware division in Canada.

Two milestones: First of all, going back to 2018, we are fortunate to partner with Joel Altman and acquire 50 percent of the Altman Cos. The reason that’s so important is that multifamily [housing] is such a strong sector for our state and also in the Southeast. The hardest part is finding good, good sites, but there’s definitely demand throughout the state for multifamily.

The other big milestone for us is what we’re seeing in our Sweet Holdings division, which includes It’Sugar, Hoffman’s Chocolates and some other brands. As department stores and others are vacating, it is providing opportunities for “retailtainment.” It’Sugar is finding good real estate and lease terms. It’Sugar has 130 locations and, on Dec. 14, we opened our largest store, a 22,000-square-foot, three-story candy department store in New Jersey. We have been open some 60 some odd days in New Jersey, and we are just hitting the ball out of the park.

Brent Burns, CEO of JM Family Enterprises

We’ve been in business for 51 years. We are Toyota’s largest customer in the world through the exclusive distributorship of Toyotas in five Southeast states: Florida, Georgia, North and South Carolina and Alabama. We also have a finance company that provides consumer loans and leases and dealer floor plans and capital and mortgage loans. We’ve got an insurance company that provides nine products. They’ve got a nationwide profile. We had a great year, last year— near record, in terms of volume sold. For our dealers, it was their most profitable year.

Each one of our businesses has a different element to it, but at their core, they’re all about helping our franchise dealers become more successful.

We did a big acquisition in 2019—Home Franchise Concepts, the franchisor for Budget Blinds, Tailored Living, Concrete Craft and Advantaclean. That is leveraging that core competency of helping our franchisees be more successful in exceeding consumer expectations.

Consumer credit and the economy in general continues to be strong. The Fed ramped rates up middle of the year last year, then they backed off. [The March Fed 0.5 percent rate cut came after the panel discussion.] We’ve got a very accommodative interest rate environment that I think sets us up nicely for 2020.

USMCA was signed by the president and that is a big, big plus. Most people when they think of Toyota, they think of being a Japanese company. Actually, their largest market in the world is the U.S.

We’re excited about the prospects for 2020. We think this coronavirus and the Chinese supply chains are going to be an interesting dynamic that that we’re all going to have to deal with here in the short term, but consumer confidence and an accommodative interest rate environment sets us up nicely.

Craig Green, co-president of Evergreen Sweeteners

Evergreen Sweeteners is a third-generation family company. We are primarily in the sugar business, but we also sell other food ingredients. We supply smaller- to medium-size food manufacturers and those in the candy industry, ice cream manufacturers, beverage manufacturers, bakeries and some food service. We bring in bulk sugar into our facility in Central Florida in Sanford and turn it into liquid sucrose, which is a popular food ingredient. We have our own trucking company and ship in our bulk trailers to those customers.

The first half of 2019 was challenging. The commodity business has very skinny margins and margins were squeezed in the first half of 2019. The second half saw much greater margin, so we had a real big rebound. Toward the end of the third quarter last year, a force majeure was declared by the largest sugar grower/supplier/marketer in North America. [Force majeure, such as the bad weather that hit sugar beet growers, means unforeseeable circumstances that prevent contract fulfillment.] That really affected the sugar industry, since prices were very high and companies like ourselves were scrambling. We were forced to look for offshore sugar supply. We believe that will be very advantageous for us because higher prices allow for greater margin. 2020 is looking very strong.

Andrew Koenig, president of City Furniture

2019 was actually our best year ever. We grew 25 percent and one of the big milestones was entering the Orlando market. Now, we have the No. 1 and No. 2 store in that market. Business is feeling really good. It’s half execution, half great demographics—population growth, housing is on fire, employment and wages.

We’re pretty bullish on this this coming year. We had to deal with the tariffs all year last year. If it got too high, we had to pass on those costs to our customers. But luckily, for us, for good retailers, the prices were really strong already. You’re already providing strong value.

Another unfortunate milestone was Hurricane Dorian coming last Labor Day weekend, which was really a big impact to us.

We don’t see our competition as the Rooms to Gos and the Eldorados. We actually see it as Amazon. To survive, you have to have a phenomenal customer experience. To have that, you need to have phenomenal systems and data teams. The last three to four years we have been overhauling our technology. We’re really building an army, almost about 100 people, when you include our contractors.

Ken Muskat, executive VP and COO of MSC Cruises

We’re part of the MSC Group, which goes between being the first- and second-largest container shipping company in the world. We’re now the fourth-largest cruise line in the world, soon to be the third-largest, overtaking Norwegian. We have 17 ships.

2019 was a great year for us. We took on two new ships, each carrying close to 5,000 passengers. We’re in the middle of just over a $15 billion new ship building program. We want to double our capacity here in the U.S.

We announced a new luxury brand that will come into the market in 2023. [MSC ordered four large superyacht type vessels.] That will be a completely separate brand.

In 2019, we opened up our own private island called Ocean Cay Marine Reserve, which is about 65 miles from Miami. Besides providing a great island experience for our guests, private islands have become a big deal in the cruise industry, because we completely control the experience and all the revenue.

On the technology side, we launched Zoey, which is the industry’s first artificial intelligence stateroom attendant. You can ask thousands of questions related specifically to that ship, such as that cruise that day’s itinerary, the weather and the shore excursions.

Obviously, big news in 2019 was being able to go to Cuba and then the bigger news was all of a sudden being told we can’t go. That had a tremendous impact on the entire industry, as well as Hurricane Dorian. But 2019 was a very strong year and 2020 is looking really good. Coronavirus is definitely going to have an impact. It’s already had a tremendous impact on our ships in China, but hopefully the impact in North America will be far less.

Bob Moss, chairman and founder of Moss & Associates

We operate in five locations in Florida, with a corporate headquarters in Fort Lauderdale and Orlando, West Palm Beach, Miami and Tampa. We’re also in Texas in Dallas and El Paso, and in San Diego. Thank goodness in all those locations, the weather is warm, people want to be there and the economy is very good.

Interest rates have never been better, and you have 1,000 people a day coming to Florida. I don’t think the Florida economy in the 35 years I’ve been here has ever been any [better].

We’ve been in business 15 years, and 2019 was a record year for us. We had our largest sales year, about $1.5 billion. We believe 2020 will be very strong. We’re very diverse. We’re building 25 different kinds of things, which is a wonderful thing because in the construction business what’s hot today is cold tomorrow. We have about 100 projects.

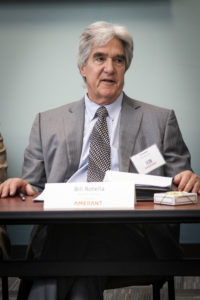

Bill Rotella, president of Rotella Group

We are celebrating our 25th anniversary this year, so that’s pretty exciting for us. I don’t think the market, at least from the commercial real estate side, has ever been stronger.

The one thing that gets written about all the time is, Macy’s is closing a bunch of stores. As bad as that is, it is creating opportunities. Everything in the retail world is experiential. Mixed use is the buzzword. I’ve been in this market since 1980 and there’s never been bigger, mixed-use projects going on.

We’re working on some projects out where Sears was shut down in Plantation. That is getting converted to mixed use. It’s going to involve a lot of a lot of experiential things, like Dave and Buster’s and a lot of interesting restaurants.

Properties are trading at a fast pace, especially net-lease properties. People get a little older and might want something that’s a little simpler. Net-lease properties don’t have a lot a whole lot of management associated with them. We see that only ramping up as interest rates stay low.

All in all, the market is real strong and the industrial market is probably as sharp as anything. The biggest challenge is that we’re a real mature market and finding the real estate to build, especially the warehouses that are required for last-mile distribution, is challenging. ♦