[vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern”][vc_column width=”2/3″][vc_column_text]

Photography by Patrick Clinton

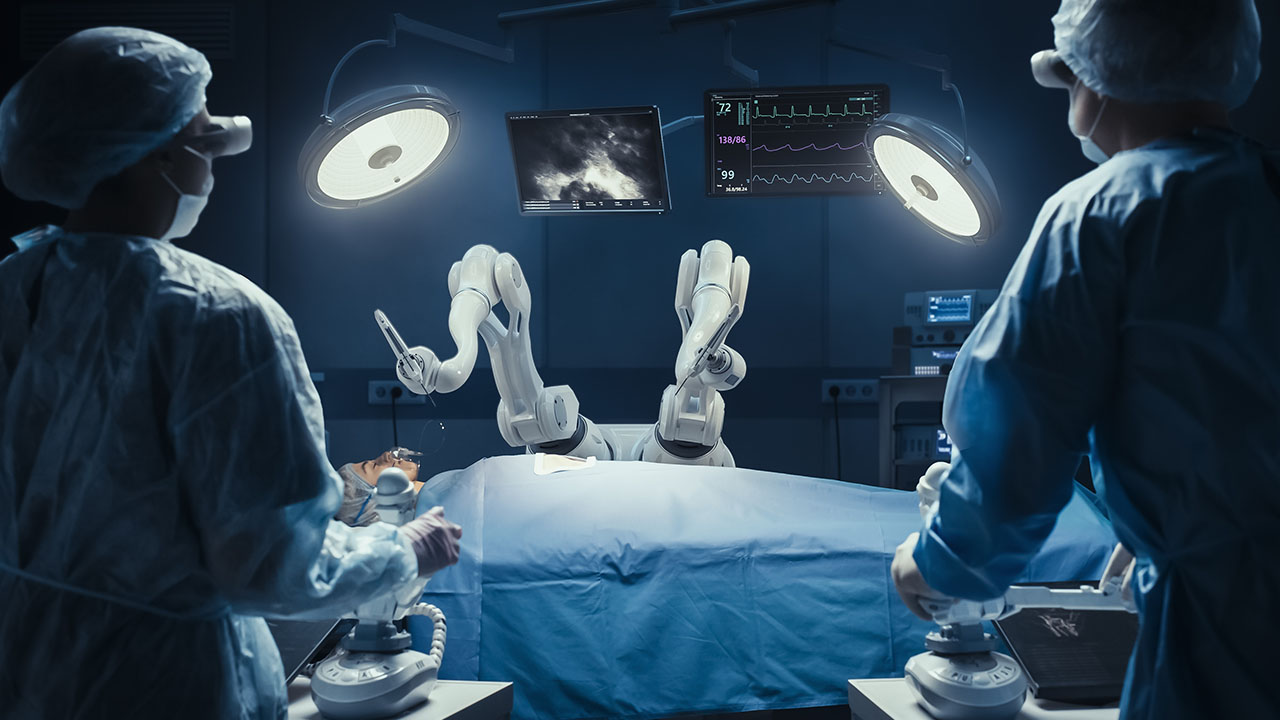

There’s Amazon for shopping. There’s Airbnb for vacations. There’s Priceline, Expedia and Travelocity for trips. Wouldn’t it be nice if there were a similar easy-to-use experience for shopping health care?

That’s the need that MediXall.com of Fort Lauderdale is trying to address, says President Michael Swartz. The company allows consumers to use their smartphones, tablets or computers to check out health care providers and related service providers.

It’s ramping up by providing information about imaging centers. In South Florida, prices for MRIs, PET scans, CT scans, X-rays and other diagnostic imaging services can vary widely—without any real difference in the quality of outcomes as well, Swartz says. MRIs can range from $400 to more than $3,000 for the same imaging.

Patients are starting to get more savvy about shopping around rather than just going to a center a doctor recommends, especially when they have high deductibles, Swartz says. MediXall cites National Center for Health Statistics data that shows more than 48 percent of the state’s population between ages 18 and 64 were uninsured in 2017 or were struggling with a high-deductible insurance policy, leaving patients paying cash for medical imaging services that they cannot evaluate or comparison-shop, because of lack of available information.

For those lacking a health insurance provider who has a list of providers, finding a database of providers can be a challenge. That’s one of the roles MediXall wants to fill.

MediXall is looking at partnering with employers who have self-insurance programs. It could help employees manage costs before they hit their deductibles, Swartz says. That fits in a scenario with many employers who offer a combination of high-deductible plans and health savings accounts.

MediXall is all about pricing transparency in the health care field. The industry has had issues with gag clauses that inhibit pricing disclosure, which is starting to get legislative attention.

For example, President Donald Trump in October signed two bills that prohibit gag orders on pharmacists. The issue was contracts preventing pharmacists from disclosing that an equally effective but less-expensive drug option was available to patients.

Swartz, who was a co-founder of Viridian Capital Advisors and served as a senior analyst from 2013 to ’15, has tweaked his approach since MediXall had a soft launch in March. Initially, the approach was to target a broad array of health care providers. The company gained an insider’s view on how pricing works and became acquainted with CoreChoice, whose specialty networks include imaging.

Swartz realized he could tap into networks with thousands of providers instead of bringing in providers one by one. Providers also would already be fully credentialed, because health plans required that for reimbursements.

MediXall formed a strategic partnership with CoreChoice.

“Just as Amazon did with books, we decided to initially launch with diagnostic imaging,” Swartz said. That was rolled out in September.

Swartz is looking to parallel that next by negotiating with lab service companies and physical therapy networks. He’s also talking with dental and vision providers. He expects the company to grow rapidly from its 15-employee head count.

He has also launched MediXallRx, which gives patients a discount pharmacy card. MediXall has partnered with a company that has relationships with a pharmacy benefit manager, which negotiates prices for specific prescriptions. The card is accepted at 60,000 pharmacies, including Publix, Walmart and CVS, he says.

For providers, Swartz has launched MediXall Finance Group, which provides customized solutions, such as patient financing and securing accounts receivable.

MediXall’s parent, MediXall Group, is publicly traded over the counter with the symbol MDXL, which Swartz sees as a way to provide transparency for investors and providers. Shares were recently trading near $2.75 with low volume. Swartz hopes to eventually be listed on NASDAQ when the business model is proven.

MediXall is backed by venture capital company TBG Holdings, which is in the same office as MediXall. Sister companies include R3 Accounting, which helps small cap companies structure their capital, and Crossroads Capital Finance Group, which helps clients with financing.♦

[/vc_column_text][/vc_column][vc_column width=”1/3″][/vc_column][/vc_row]