Confused about retirement planning? Here’s how to get started this year.

Saving for retirement is a challenge many workers face, but without an amply funded nest egg, you risk running out of money as a senior. Let’s explore your options for saving for retirement so that you can get started as soon as possible.

IRAs versus 401(k)s

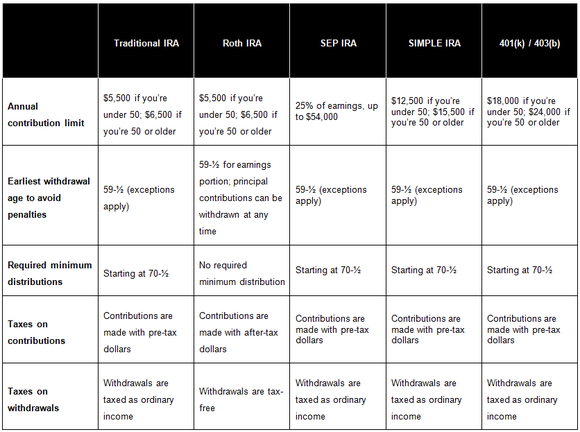

While you’re allowed to contribute to both an IRA (individual retirement account) and 401(k) at the same time, many savers tend to choose one or the other. If you have access to a 401(k) plan through your employer, signing up can be advantageous for many reasons. First, the annual contribution limits for a 401(k) plan are higher than those of most IRA varieties. Currently, employees under 50 can contribute up to $18,000 a year to a 401(k) but only $5,500 per year to a traditional or Roth IRA. Those 50 and older are allowed an additional $6,000 401(k) catch-up contribution and a $1,000 IRA catch-up, for a total of $24,000 and $6,500, respectively. Note that all 401(k) contributions go in tax-free, but withdrawals in retirement are taxed as income.

Additionally, since many employers offer matching incentives for the plans they sponsor, participating in a 401(k) could help you save even more. (If you work for a public school or tax-exempt organization, you’ll probably be offered a 403(b) plan, which is similar to the 401(k) in most regards.) With an IRA, all of the money going into your account will typically come from you, not an employer.

Not all IRAs, however, are created equal. The two most common types — the traditional and Roth — have a number of key differences. With a traditional IRA, your contributions are typically tax-free, but withdrawals are taxable in retirement. Roth IRAs work the opposite way: You don’t get an immediate tax break for contributing, but withdrawals are not taxed later on. However, there are income limits for contributing to a Roth, and if you earn too much, you won’t be eligible.

Retirement plans for small businesses and the self-employed

While large companies frequently offer 401(k)s, these plans can be costly and cumbersome for smaller businesses to administer. The SIMPLE (savings incentive match plan for employees) IRA is a more cost-effective option for businesses with up to 100 employees. If your company offers a SIMPLE IRA, you’ll be allowed to contribute up to $12,500 a year if you’re under 50. If you’re 50 or older, you’re allowed a $3,000 catch-up for a total of $15,500 per year.

Furthermore, employers are required to match contributions to a SIMPLE IRA, either by contributing a fixed rate of 2% of every employee’s compensation (regardless of participation in the plan), or by matching employee contributions up to a maximum of 3% of compensation. If you’re self-employed, you’re allowed to open a SIMPLE IRA and contribute as both employer and employee.

Another option available to small businesses and self-employed workers is the SEP (simplified employee pension) IRA. Like SIMPLE IRAs, SEP IRAs are easy and cost-effective to set up and maintain. SEP IRAs, however, come with a much higher annual contribution limit. This year, employers can contribute up to 25% of employees’ salaries up to $54,000. (Note that if you’re self-employed, that 25% threshold applies to net earnings from your business.)

If you own a small business, a SEP IRA might allow you to sock away a sizable chunk of money tax-free. But remember that as an employer, you’re required to make the same contribution percentage-wise to your employees’ accounts as you do to your own.

Finding the right plan for you

Navigating the different retirement plans out there can be tricky, but here are some key points to consider when making your decision:

- Contribution limits — how much can you contribute each year?

- Tax benefits — will you receive an up-front tax break for contributing?

- Taxes in retirement — will your withdrawals be tax-free, or will you pay taxes on distributions as a senior?

- Other restrictions — will you have the option to withdraw your money early if need be, and will minimum distributions be mandated in retirement?

The following chart will help you compare your options to see which type of plan might work best for you:

TABLE BY AUTHOR.

No matter which type of retirement plan you choose, the key is to start contributing as early as possible to give your money a chance to grow. As an example, contributing $300 every month for 35 years will give you an ending balance of over $400,000 if your investments generate a relatively conservative average annual 6% return. Given that many people are living longer these days, the more you’re able to save along the way, the greater your chances of being able to fund the comfortable retirement you deserve.

The $15,834 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.