All three South Florida counties have upcoming ballot measures to improve funding for school districts with school security and teacher salaries as major factors.

The state is requiring law enforcement and improved mental health care on every campus in the wake of the shootings at Marjory Stoneman Douglas High School, but legislators didn’t provide enough funding for school districts that have to implement the program.

Business groups in South Florida consistently say improving education in South Florida is vital, so this could be a litmus test on whether voters are willing to get out their checkbooks.

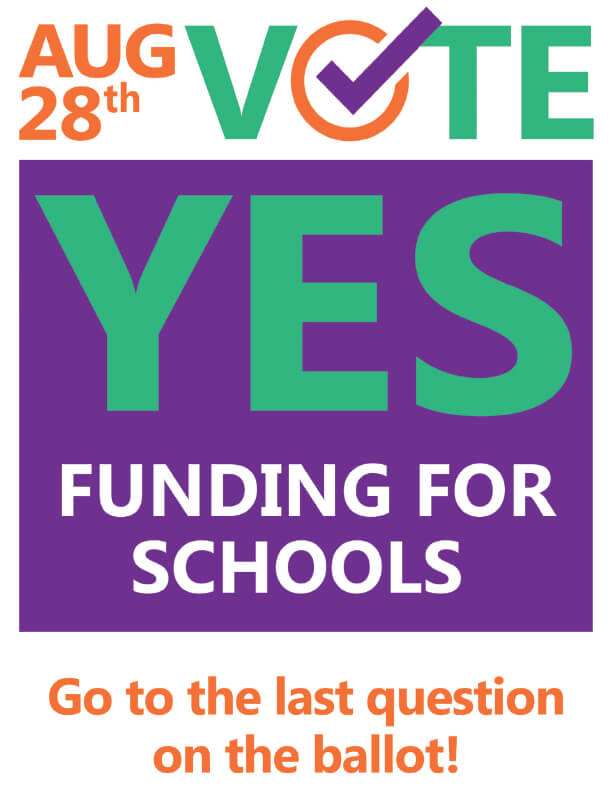

The first ballot measure is on Aug. 28 in Broward County while measures in Palm Beach and Miami-Dade counties are on the ballot in the November general election.

The Broward Workshop is among the business groups supporting a 1/2 mill increase in the Broward property tax rate, which would be about $120 per year for someone with an average home of $240,000. It would generate $92.8 million starting in fiscal 2019/20.

In Broward, 72 percent of the additional revenue would go towards improving salaries for teachers and non-administrative staff. School security would get 20 percent and the remaining 8 percent would be for more guidance counselors and mental health programs.

Among the selling points the Workshop gives are:

- The state only increased the budget for Broward County Public Schools (BCPS) by 47 cents per student in the Base Student Allocation for the 2018-2019 school year.

- Due to inflationary and mandatory increased costs, the school district has an almost $18 million deficit.

- Broward County has the largest gap between salaries and the cost of housing. Many teachers struggle with the cost of housing and other expenses.

- The 2014 SMART Bonds can only fund capital improvements and maintenance, not salaries or operating expenses.

The business group has been supportive of School Supt. Robert Runcie and cited recent momentum in the district, such as 96 percent of schools getting an A, B or C rating from the state and the graduation rate hitting the highest level since 2011.

The Miami-Dade School Board in July approved ballot language that will ask voters to increase property taxes by 75 cents per thousand dollars in taxable value, which amounts to less than $142 for the typical homeowner, according to school district calculations reported by the Miami Herald. The tax increase would generate an extra $232 million a year, which the school district plans to use to give teachers a raise and hire additional security personnel.

Palm Beach County’s school board is seeking $1 for every $1,000 in taxable value, which would raise $800 million over four years, the Palm Beach Post reported. Half would go towards teacher salaries, one quarter towards school safety and guidance counselors and the last quarter for continuing the arts teacher program and to hire additional elective teachers. Art teachers could find their positions eliminated if the referendum fails.