Dear Mr. Berko: One of the men I admire is Claes Fornell, whom I met at Duke University. He developed the American Customer Satisfaction Index, or ASCI, and also manages an exchange-traded fund by that name. He purchases companies for his ETF that have the highest customer satisfaction rate, using his patented algorithm to identify these stocks. The customer satisfaction rate is computed from a survey of 100,000 consumers, and this is a brilliant way to pick the stocks that consumers like best. Because these consumers will be repeat customers, they’ll spread the word. This will increase revenues and profits, as well as the company’s ability to charge higher prices than their rivals for similar products. The hope is that this pushes the stock price higher. Professor Fornell seems to have a better way to analyze stocks. So I’m considering investing $9,000 to buy 300 shares of this ETF, and I would like your opinion. — SF, Moline, Ill.

Dear SF: Professor Fornell does not select the stocks for this ETF. Rather, his methodology is used by Phil Bak and his team to populate the ACSI portfolio. However, the man I admire most is Volodya “Big Dog” Sanchez, who lived in Colonial New England and discovered that lobsters are edible.

The investment you’re asking about is called American Customer Satisfaction Core Alpha ETF (ACSI-$28). And it’s my experience that the longer a stock’s name the worse it performs. ACSI began life in November 2016 and has $17 million in a silly bare-bones portfolio. In a prior life, Phil Bak was a managing director of the New York Stock Exchange. Bak and associates scour the data from Fornell’s American Customer Satisfaction Index. Then they use this data to create the American Customer Satisfaction Investable Index, which their ETF tracks. How lovely! This index is an economic indicator that measures consumer satisfaction with the goods and services they purchase. The index covers 43 different benchmarks (over 300 companies) — such as airlines, banks, breweries, credit unions, full-service restaurants, department stores, hotels, hospitals, insurance companies, energy utilities and dating services — and adjusts on a quarterly basis. A company’s weighting in the ETF is restricted to 5 percent of the index and also rebalanced quarterly.

In my opinion, this ETF is a worthless, gigantic yawn — a dippy excuse to be different and attract investors. ACSI’s 3.4 percent total return since November sadly trails a 6.7 percent total return for the Standard & Poor’s 500 index. About 40 percent of ACSI’s portfolio includes Yahoo, T-Mobile, Dr Pepper, eBay, Vonage and HP. Utilities, consumer cyclical issues and consumer defensive issues make up 60 percent of its performance, which is as exciting as watching a Japanese Kabuki dance.

Bak’s portfolio is sterile, and his methodology needs a shot in the fundament. Though a focus on customers’ satisfaction and becoming repeat customers is unique, it don’t pop my cork. Successful investing uses such time-valued metrics as earnings, book value, cash flow, dividends, operating margins, net profit margins, return of capital, debt and working capital, which are based on historical performance. Though past performance is not a guarantee of future results, it’s certainly a better indicator of a company’s future stock price than knowing whether Otto, Paul and Priscilla like Vonage.

So no, a thousand times no, I cannot recommend ACSI shares for two reasons. 1) I don’t share your awe of Fornell. Though his methodology is used by industry movers and shakers to measure how well companies are perceived by the public, it’s not an acceptable way to predict the future performance of companies. 2) Because this ETF is so small (a $17 million portfolio), I doubt it can stay around long enough to be meaningful. The quarterly costs to run ACSI exceed its ability to pay salaries and accounting and operational expenses. Therefore, I suspect that either ACSI will close its doors soon and distribute its assets to shareholders or a larger ETF will take over the portfolio.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

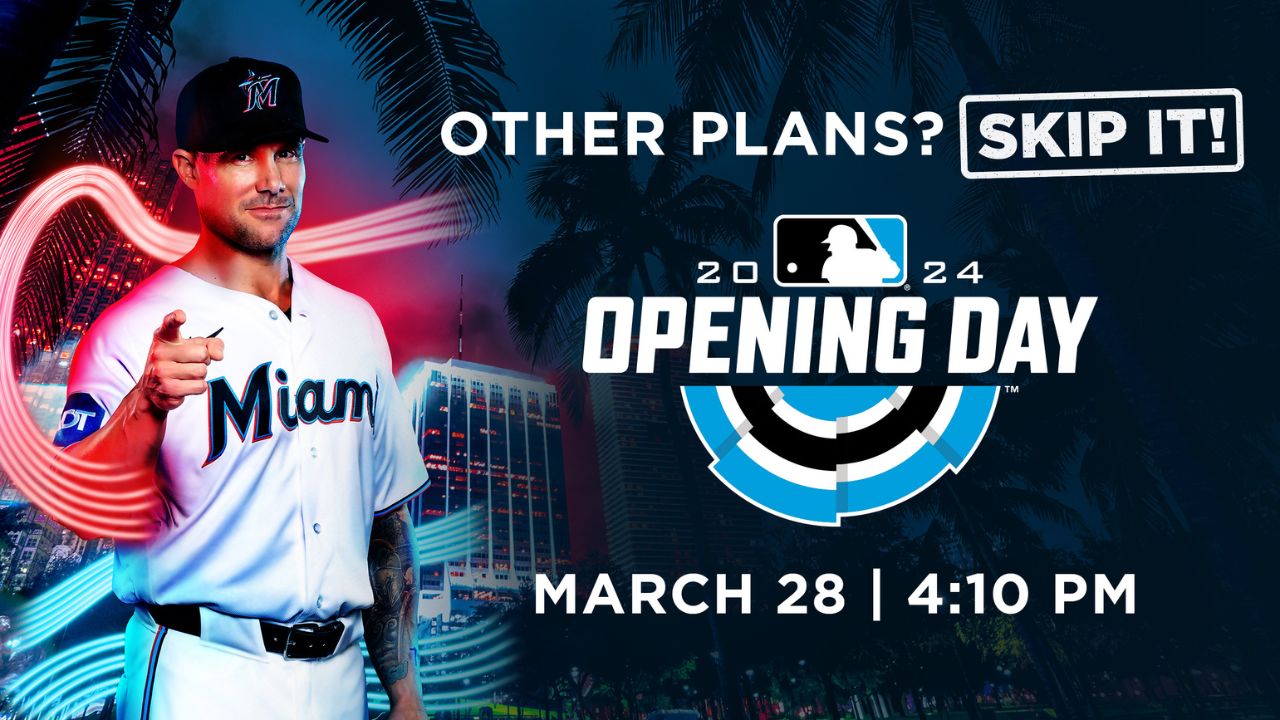

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was