Dear Mr. Berko: Our 27-year-old son graduated college with a degree in sociology. He is our only child, lives with three other guys and owes $112,000 on student loans. He has asked us to pay if off and said he will give us $200 a month. We’ve enclosed our financials for you to review. Please tell us whether we should cash in part of our annuities, cash in part of our individual retirement accounts, withdraw from our certificates of deposit or take a mortgage on our home. He recently found a job at Starbucks and can pay us from his wages and tips. — TE, Joliet, Ill.

Dear TE: No, a thousand times no! Don’t be daft and don’t dip into your retirement money. A college degree and your kid pours coffee at Starbucks?! Pray he marries well! Like many parents, you’ve yet to learn that most kids who borrow from parents don’t feel an obligation to repay them. What in blazes did he do with that $112,000?

In November, the Government Accountability Office (GAO rhymes with dough) announced that the U.S. is on track to forgive about $108 billion in student loans. Last year, more than 3,000 people a day defaulted on their federal student loans. This year, the Trump administration’s “special” income-driven repayment plan will write off about 10 percent of existing loans, and those write-offs may grow annually. According to the GAO, borrowers under the income-driven repayment plan have an average debt of $67,000 (some owe over $200,000), and the numbers are growing. Total student debt is $1.4 trillion, which is among the most outrageous boondoggles in history. And moonstruck millennials, whose numbers have surpassed the baby boomers as the nation’s largest living generation, have sucked this teat dry. These wastrels have used our tax dollars as slush funds to purchase cars, buy motor scooters, pay rent, buy concert tickets, take European vacations and buy clothes, wine and pot.

Your kid pours coffee at Starbucks, and without job skills, he probably isn’t qualified for very many other jobs. What’s the worst that could happen if he were not to make payments on his student loan? He wouldn’t be arrested, placed in jail or pilloried, though I’d recommend it. Sign him up for the government’s income-driven repayment program. The IDR program will cap your kid’s monthly payments at 10 percent of his discretionary income, which is defined as adjusted gross income above 150 percent of the poverty level. The federal poverty level is $12,000 a year, and 150 percent of that amount is $18,000. So 10 percent of everything your kid makes above $18,000 will be used to pay off his student loan. If your kid takes home $20,000 a year, his loan payments will be $200 a year. At this rate, this loan will never be paid off, because annual interest will exceed his payments. So after 20 years of his making silly $200 annual payments, the government will forgive the balance because accruing interest will be higher than the original amount owed.

Some quockerwodgers in Congress recognize it’d be cheaper to forgive your kid’s $112,000 student loan now than it would be later. Do the math. After payments of $200 a year over 20 years, your kid’s loan, at 4.5 percent, would grow to $220,000. I’m amazed that some members of Congress actually understand this dilemma and that Congress may approve early forgiveness, providing the forgiven amount is treated as ordinary income. So hold your water and don’t do anything you’ll regret — namely, liquidate assets to pay your kid’s debt. In the next few years, Congress will probably pass some sort of legislation enabling students to walk away from their debts scot-free. That’s the new American entitlement!

You folks are retired with $68,000 in CDs, annuities worth $617,000, IRAs worth $72,000, one pension paying $16,800 annually and joint Social Security income of $23,000 annually. If you really, absolutely and unreservedly must pay this debt, don’t take money from your annuities or IRAs, because they’re taxable. Consider a lump-sum reverse-annuity mortgage for $112,000, which wouldn’t be taxable and would only need to be repaid from the proceeds when you sell your house. However, some would say a $10,000 cash contribution to a certain member of Congress might make your kid’s debt disappear faster.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

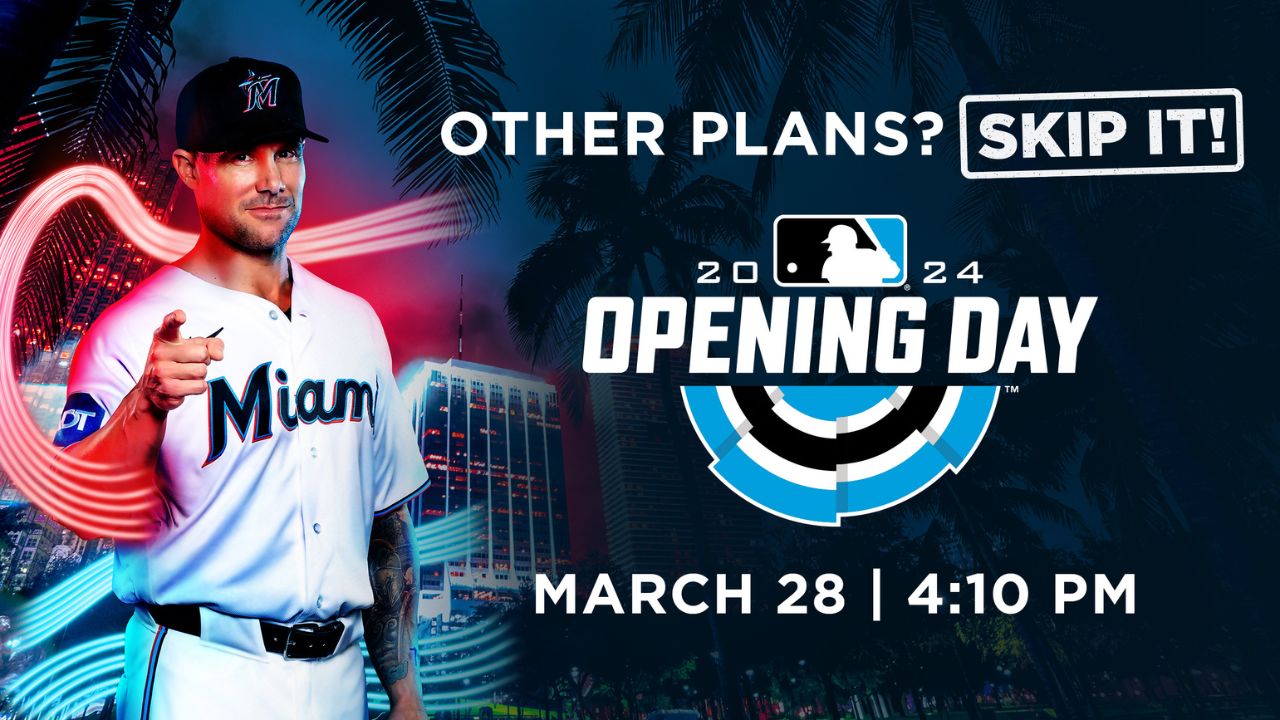

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was