Dear Mr. Berko: I bought 200 shares of Snap on the offering. I was surprised I got the stock and bought 1,000 more shares at $24.25 when it began trading. It quickly jumped to $30. But a short time later, it was trading at $18 because the company had reported a record first-quarter loss of over $2 billion and slower user growth. Several of my friends and I have lost thousands of dollars. The stockbroker we use strongly recommended this stock, telling us that Snap’s business, according to his firm’s analyst, is “so sensational that it could go to $100.” My friends and I have used this broker for a couple of years. I should have realized, though, from his past recommendations that he’s what you call “an articulate incompetent.” All of us are really angry about this. His Snap recommendation was so wrong that we are thinking of a class action suit against him and his firm. What would you advise? — AE, Columbus, Ohio

Dear AE: When greed succeeds, everyone smiles. When greed fails, everyone wails. You and your room-temperature hobbits must never have taken the time to read the company’s prospectus dated Feb. 2, 2017. If you had, I guarantee that you would not have bought the stock. Actually, perhaps you would have, because stupidity and greed are usually good companions. Hidden among the single-spaced small print and monotonous gray lines is this passage: “The growth in Daily Active Users was relatively flat in the latter part of the quarter ended September 30, 2016.” That comment might even discourage Forrest Gump from buying Snap.

The prospectus was so boring and the language so stilted that I couldn’t wait to put it down. (One of these days, the Securities and Exchange Commission will require prospectuses to be simple enough that people who are not lawyers can easily read them.) In the prospectus, management constantly reminds prospective investors that the most important driver of Snap’s (SNAP-$20.28) future and success is continued growth in the number of daily active users of its Snapchat app. Without strong DAU growth, advertising revenues will decline and SNAP will implode. You guys remind me of a circle of yakking gobemouche’s with too much money, too much time on your hands and not enough common sense.

Greed encouraged you and your friends to be scammed, shammed and sucker-punched by J.P. Morgan and Goldman Sachs, which were the lead underwriters of SNAP. How could these prestigious, sophisticated underwriters (the Mensas of Wall Street), who’d been camped in SNAP’s backyard for months, fail to anticipate a $2.2 billion loss and disappointing DAU numbers for the first quarter of 2017? In fact, anyone who read the prospectus would know that this was the fourth consecutive quarter of declining DAU growth. Some have suggested that there may have been collusion and iffy dealings between SNAP and the people at Morgan and Goldman. Many say the professionals at Morgan and Goldman told you the truth but not the whole truth. Others suggest that excessive drug use (an epidemic at many big brokerages) among underwriting participants may have caused key employees to make wrong decisions. It may have been a combination of all of the above. You got shafted.

SNAP’s competition is tough, especially from Instagram, which counts over 200 million daily active users, compared with Snapchat’s 166 million. Instagram is a Facebook (FB-$150) property, and FB has the resources to continue expanding Instagram’s usership and advertising. It’ll be a struggle for SNAP to compete, and frankly, I can’t imagine things getting better from here. Management has struggled to sustain user growth, while Instagram has adopted appealing features that imitate Snapchat. There is, however, an opportunity that would present an acceptable solution. Alphabet could be interested in purchasing this smaller competitor. Certainly, SNAP lacks the right crackle and pop to go it alone.

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

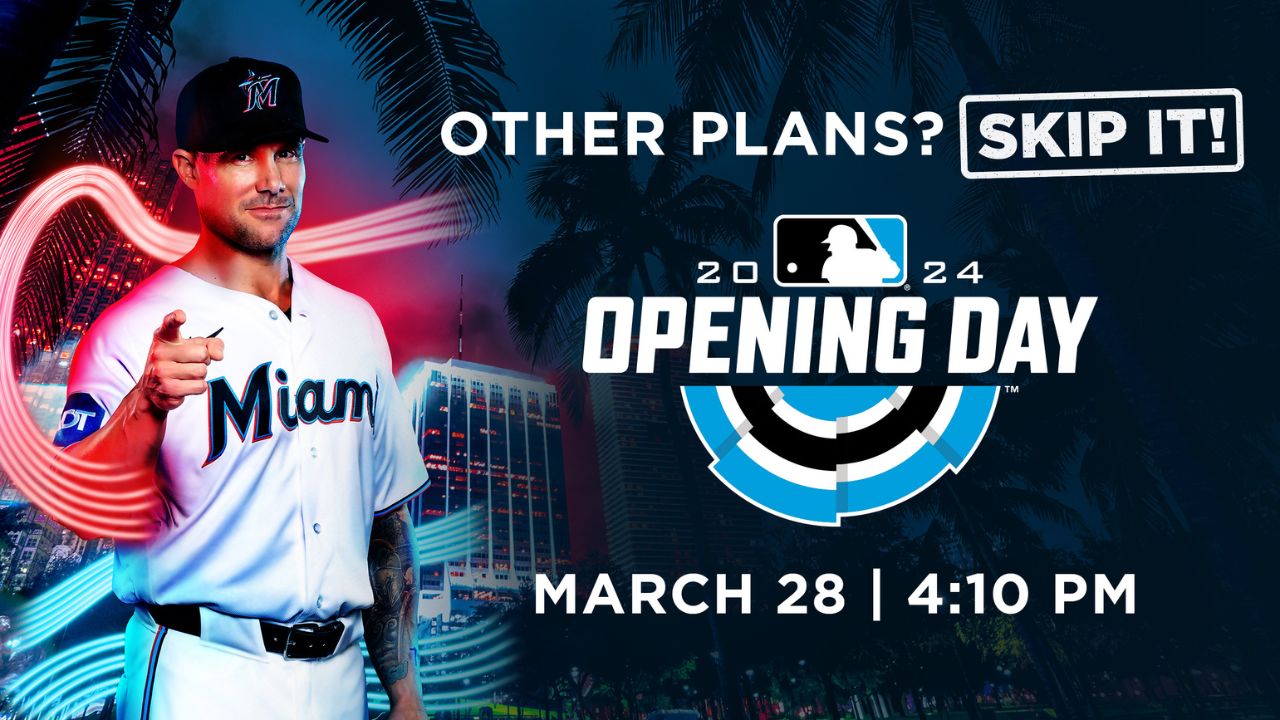

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was