Here are the best retirement funds for every type of investor.

By Jordan Wathen

When I think about the best funds for a 401(k), I think of a few traits in particular. A fund should be inexpensive to hold, have diversity in its portfolio, and perhaps invest in higher-yielding stocks to generate more income.

Of course, no single fund will hit every requirement. But some come pretty darn close. Here are three top-tier mutual funds selected from the funds you’re most likely to find in a retirement account — target date funds, index funds, and income funds:

1. Vanguard 2050 Target Retirement Fund (NASDAQMUTFUND:VFIFX)

2. Schwab S&P 500 Index Fund (NASDAQMUTFUND:SWPPX)

3. Vanguard High Dividend Yield Index Fund (NASDAQMUTFUND:VHDYX)

Target retirement funds

Want a one-and-done retirement plan? It doesn’t exist, but target date funds are the next closest thing. It’s all about convenience — target date funds automatically allocate to lower-risk investments as you near your retirement date.

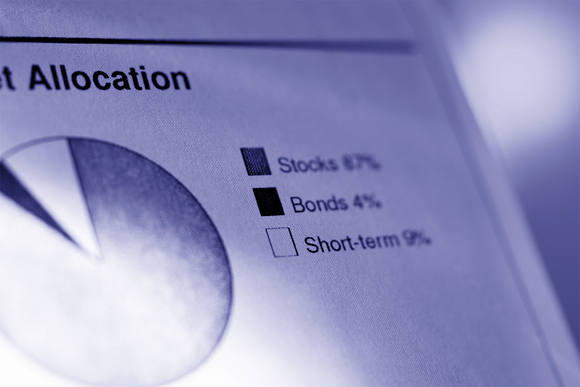

You shouldn’t buy one of these funds without first looking under the hood, however. The allocation you might expect for any given retirement date might be vastly different than how a manager allocates its funds. Note that Fidelity’s funds carry significantly more stock allocation than Vanguard’s funds at a given retirement date, for example.

Can retirement planning be one-size-fits-all? Absolutely not. Could you do better than a target date fund? Possibly. But it’s probably the best option for hands-off investors. That goes double for younger investors, whose ultimate results have more to do with their savings rate than how perfectly allocated their funds are.

Widely available in retirement accounts and, most importantly, inexpensive, these funds are great for the low-effort crowd. Vanguard’s funds costs less than 0.20% annually, while Fidelity’s carry expense ratios as high as 0.76%.

Take the index

Over long periods of time, the value of all businesses should go up. Naturally, stock prices should go up too, and you could do much worse than to simply get the results of large cap stocks in the United States.

Even the world’s most successful investor, Warren Buffett, agrees — he’s instructed his trust to manage his wife’s wealth by putting 90% of its money in the S&P 500. The other 10% will be allocated to short-term government bonds.

A fund like the Schwab S&P 500 Index Fund can be an excellent way to invest in a diversified manner across 500 of some of the world’s most important companies. It’s also the least expensive fund available, carrying an expense ratio of 0.09%.

Given that the S&P 500 makes up roughly 80% of the value of all stocks listed on American exchanges, you’re not missing out on much by holding an index that tracks it. Therefore, making it a core part of your portfolio wouldn’t be unwise. Most importantly, these funds are almost universally dirt cheap, ensuring that more of the return makes it into your pocket.

A fund for income

There are countless dividend funds out there, many of which sacrifice safety in their strategy to generate the most income on a current basis. (Several funds just buy the highest-yielding stocks, regardless of the prospects for the underlying business.)

I like the Vanguard High Dividend Yield Index Fund because it currently generates about 50% more yield than the S&P 500 index, all from a portfolio of well-known household name stocks. Among its top positions are companies likeMicrosoft, Johnson & Johnson, and Wells Fargo, hardly anything exotic.

Recent performance has been spectacular, as it beat the market by about 0.6% per year over the last 5 years with a simple indexing strategy that results in a tiny expense ratio of just 0.16% annually.