Dear Mr. Berko: I’m writing for our 18-member investment club, which has been active since 1994. In 2008, we discovered Yahoo Finance. It was great, and we used it to help us research stocks for our $677,000 portfolio. It was first-rate and superbly laid out, with volumes of useful information in a logical and easy-to-understand format. We benefited individually and as a club. Months ago, Yahoo changed the site’s composition. Now it’s a botched-up, useless mess. All of our members and other investors we’ve talked to say the site is rubbish and cluttered. We’ve called Yahoo, but no one answers the phone at its headquarters. And I’ve been tasked to find another financial site, which is the reason for this letter. Could you recommend another financial site we could use?

Our club doesn’t reinvest dividends. Nine members voted to reinvest our dividends to purchase stocks already in our portfolio, but nine say we should use our monthly dues (and raise them, too) to purchase new stocks. What say you? — CK, Chicago

Dear CK: Yahoo changed the site without telling a soul! Like you, investors don’t care a ding-dong for the new, mucked-up site, which has generated howls of angst and an uncommon volume of antipathetic mail. I am familiar with the old site and agree with your conclusions. Today’s Yahoo Finance site is managed and formatted by a gaggle of dopes and misfits.

Yahoo (YHOO-$47) was horribly hacked in 2013, but management just quivered and sucked its thumbs. In 2014, personal data on 500 million accounts was compromised. And management just frolicked about like a bunch of mutant ninja turtles. If Verizon (VZ-$77) completes its YHOO acquisition, VZ customers should worry that their personal data from their computers and cellphones may be accessed by hackers. And I’m told that some VZ phones might explode if connected to Yahoo during a solar eclipse!

Go to https://www.nasdaq.com for your new data searches. It’s not so good as the original Yahoo Finance, but it’s boundlessly better than the new site. It’s also free, and that’s a good price. Morningstar and Value Line are superb but costly services.

Readers, if you have other alternatives, email them to me, and I’ll share them with hundreds of fuming investors.

On March 15, RK from Oklahoma City wrote: “I’ve been an investor for more than 25 years. In mid-1991, I initiated a DRIP (dividend reinvestment plan), reinvesting my Dominion (D-$77) dividend as a college fund for my three granddaughters. I’ve invested $100 a month since July 1991, a total of $30,700. I’ve accumulated 2,499 shares, worth $192,423 at today’s price. This is more than a 600 percent return during that period and a good example of reinvesting dividends over time. Of course, Dominion was in the low $20s when I began this journey, and $100 bought about five shares, whereas today $100 buys a little more than one share.”

CK, that should answer your question about reinvesting dividends. Meanwhile, increase your monthly dues.

Back in the late 1950s, before I got fired from Merrill Lynch, Merrill was selling an idea called a monthly investment plan, or MIP, which was aggressively marketed to the hoi polloi. The Merrill philosophy then was “investigate before you invest,” but it’s certainly changed since. The MIP concept encouraged Middle America to learn about investing while participating in the stock market and accumulating a varied stock portfolio. Merrill believed that eventually, many DRIP investors would be professionally successful and become better clients for the firm. At that time, Merrill was called the “thundering herd.” The MIP concept is brilliant but simple: Research a sound, profitable dividend stock, and invest as little as $10 each month. The costs are low, and the dividends are automatically reinvested. And with the discipline of regular monthly payments plus the magic of compounding dividends, various MIP investors eventually find that they’ve built a Golconda. So reinvest you!

r dividends, too!

Please address your financial questions to Malcolm Berko, P.O. Box 8303, Largo, FL 33775, or email him at mjberko@yahoo.com. To find out more about Malcolm Berko and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2017 CREATORS.COM

Editor’s Letter: Everything Still Seems Pretty Good

I don’t know about you, but I am getting tired of waiting for a recession. Yes, there are a few worrisome signs nationally, such as vacant office space and we

Local South Florida Cocktail Recipes to Craft During National Cocktail Day

The celebration will commence on Sunday, March 24.

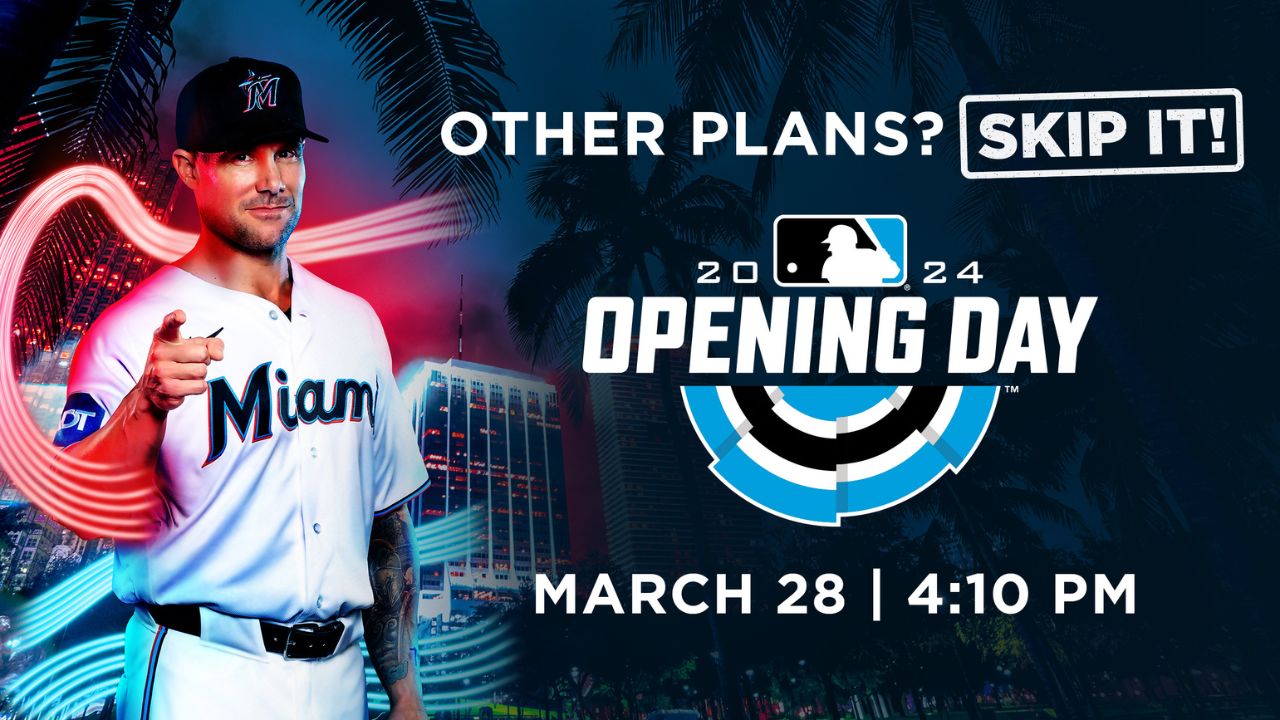

Miami Marlins Set to Kick Off Much-Awaited 2024 Season

The team will host the Pittsburgh Pirates for the home opener on March 28.

Healthcare Investor Hosts Fundraising Event for Fort Lauderdale Mayor Dean Trantalis

The evening will feature a Frank Sinatra impersonator, networking and a chance to raffle prizes from Amaira Med Spa & Surgical.

Other Posts

Fort Lauderdale International Film Festival Hosts Oscars Watch Party

Space is limited and advance purchase of tickets is required.

Desai Foundation Hosts Holi Celebration in Miami

The aim is to raise awareness and support for health, livelihood, and menstrual equity programs in India.

Set Sail for Fun: Inaugural Red Shield Regatta Launches in March

The evening will be hosted by Captain Lee Rosbach of Bravo TV’s Below Deck.

Editor’s Letter: A Heartfelt Return

If you are a longtime SFBW reader and are wondering what the heck I am doing back here with an editor’s column, well there’s a story behind that. It was