By Darcie Lunsford

Pop singer Meghan Trainor is “all about that bass, ’bout that bass,” but in commercial real estate, it’s all about the lease, ’bout that lease.

And leasing is all about absorption. That’s the net difference between how much space is vacated and how much space is leased in any given quarter or year.

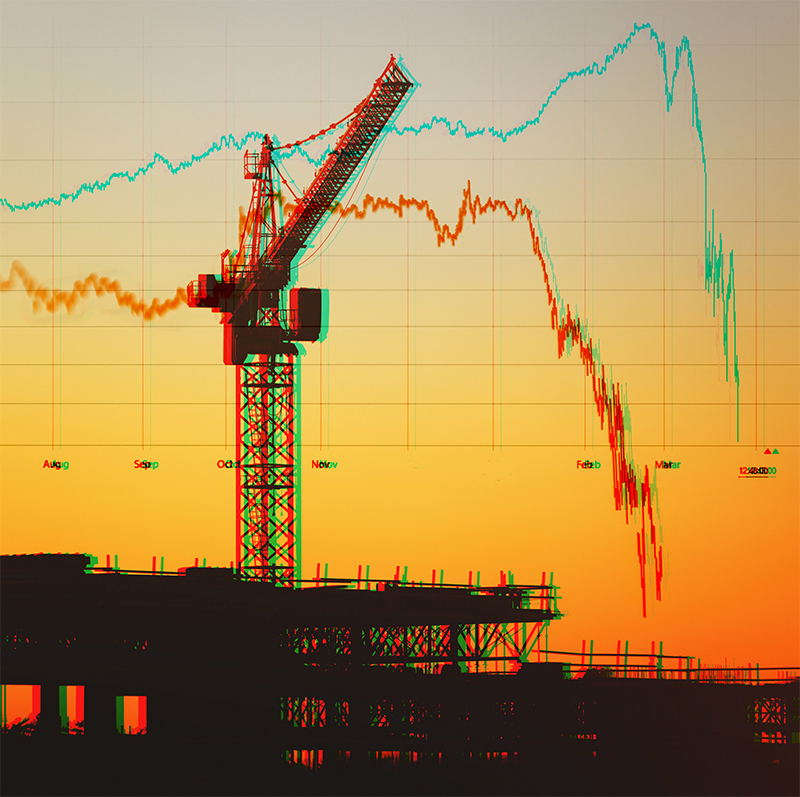

For the past four years, the region’s office and industrial markets have seen a steady tide of positive absorption. While that isn’t changing, absorption velocity might signal that the region’s leasing markets are peaking.

Across the region, the positive office and industrial space absorption was less in the first quarter of 2016 than in the first quarter of 2015.

Is this a blip … or a trend?

“We might be sliding into somewhat of a recessive market,” says Caroline Fleischer, managing principal of Cresa South Florida, a corporate tenant representation firm. “Our commercial real estate model is that we have a cycle every few years, and we are coming off a nice cycle, so everyone is just not as bullish right now.”

Fleischer cites a confluence of factors – including presidential election concerns, Britain’s exit from the European Union and what the Federal Reserve will do with interest rates – as the drivers of a burgeoning corporate uncertainty.

Despite slower market absorption, megadeals are still getting done.

Bank of America, for instance, just inked a deal for 62,000 square feet of offices in Boca Raton’s One Town Center, near the Town Center at Boca Raton mall off of Glades Road. The 10-story building is probably best known as the former home of Tyco International.

Further south, GMMI, a health care management firm, leased 36,000 square feet – the entire top floor – in the new Pembroke Pointe midrise at Interstate 75 and Pines Boulevard.

Burger King signed a lease for a 150,000-square-foot, build-to-suit corporate headquarters in the Waterford at Blue Lagoon office park, near Miami International Airport. But because the fast-food giant will vacate 200,000 square feet in the same area, that will actually cause a 50,000-square-foot reduction in absorption when its new digs open in 2018.

Generally, the quarter-over-quarter reduction in office space absorption was more modest.

It’s the region’s hearty industrial sector that took the most glaring hit to first-quarter absorption when compared to the same quarter last year.

In Miami-Dade County, the region’s largest industrial hub, year-over-year absorption fell by nearly 40 percent in the first quarter, according to CBRE data. “For the largest deals, there may be a slight slowdown,” says Michael Silver, first vice president of CBRE. “Deals are taking longer to close.”

Even so, Silver says the industrial market in Miami-Dade County has not peaked and he anticipates that slower deal volume in the early part of this year will be made up later in the year.

“I think it is a blip,” he says. “I think we will keep pace with last year and historic absorption for Miami. The county, despite a flood of new construction, has still seen about 3 million square feet of positive absorption for the past three years.

Similarly, Broward County saw a 44 percent dip in year-over-year absorption.

“The momentum is still there,” says Chris Metzger, executive director of Cushman & Wakefield. He says tight industrial vacancy means there’s a shortage of new inventory, which limits the ability of companies to grow and move. Palm Beach County industrial absorption dipped 48 percent, year over year.

Metzger compares the point we’re at in the current cycle to where we were in 2006. But unlike that year, Metzger and others say there isn’t a cliff at the end of this cycle.

Says Metzger: “I think it is going to be just a flattening out of the market.” ↵

Freelance writer Darcie Lunsford is a former real estate editor of the South Florida Business Journal. She is the senior VP for leasing at Butters Group and is avoiding a conflict of interest in her column by not covering her own deals.