By Darcie Lunsford

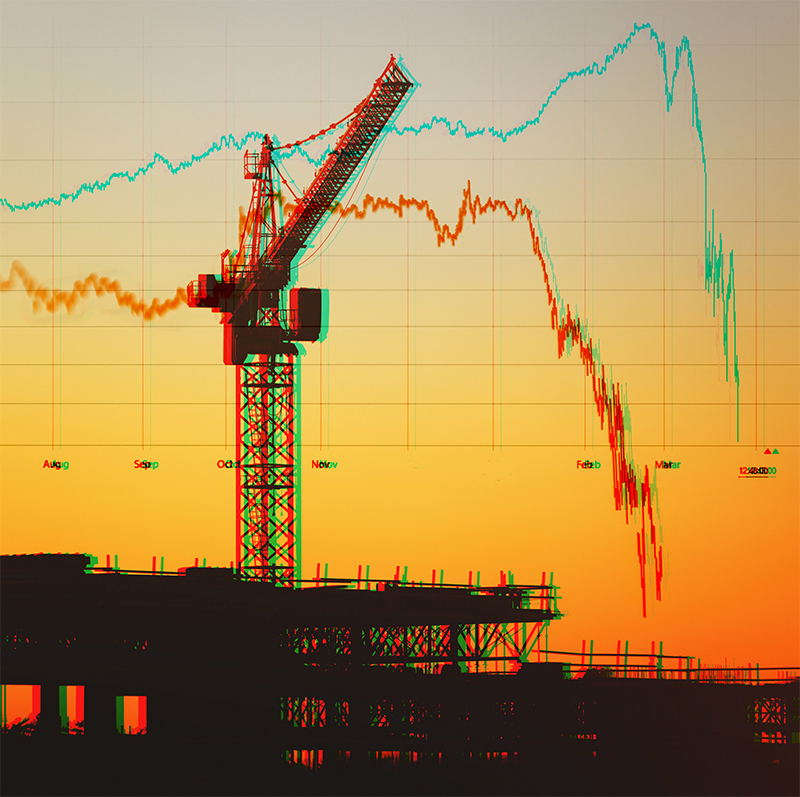

After soaring to record levels in 2015, commercial real estate sales volume fell last year, tethered by fewer massive portfolio transactions, tightening monetary policy, pre-election vitriol and post-election consternation.

Nationally, the total sum of offices, industrial buildings, hotels, shopping centers, apartments and commercial development sites that traded hands in 2016 fell 9.6 percent compared to the year before, according to Real Capital Analytics, a New York-based research firm.

Last year, $493.6 billion of commercial assets sold, compared to $546.2 billion in 2015.

South Florida’s overall sales activity generally followed national trends, but the region did not see much of a slump, dipping only 1 percent compared to 2015, data shows. A scant $196 million separated the $18.7 billion of commercial transactions in 2015 to the $18.5 billion that traded last year.

But to keep this in perspective, sales volumes for both 2016 and 2015 surpassed the region’s previous record peak of $16 billion in 2005, where in a single quarter more than $5.3 billion in properties sold.

Some experts say, however, that the post-recession run, which really didn’t catch a tailwind until 2014, might already have plateaued.

“We are probably near the top of the cycle,” says Wells Fargo senior economist Mark Vitner. “Projects need to clear a higher bar in regards to potential risk and reward.”

But not all classes of assets were out of favor despite the broader volume deceleration. Similarly, investor appetite was not geographically homogenous with demand for South Florida office, industrial and apartment assets bucking national trends.

While down 4.5 percent nationally, transaction totals for South Florida office buildings surged 18.9 percent in 2016 with nearly $4.4 billion in sales, RCA data shows.

Sales volume for industrial assets in South Florida also accelerated 2.3 percent to $2.2 billion while sales nationally dropped 24.1 percent, data shows.

South Florida apartment sales, which have been a clear standout throughout this recovery, continued to show that they are still the darling, zooming up 40 percent compared to 2015 with $6 billion in sales. Nationally, apartment sales volume was up, but only a modest 4.2 percent.

There were dramatic declines in South Florida retail, hotel and land transactions, all down about 30 percent compared to their 2015 levels, data shows.

“The political climate has bolstered consumer and business confidence, and there are hopes that the recovery will catch a second wind,” Vitner says. “This may happen, particularly in regard to industrial projects. Office and apartment markets have seen values increase fairly sharply in recent years and demand is now expected to grow more modestly from a user standpoint. We are still very optimistic about 2017 but look for more modest gains in employment and some moderation in most aspects of the commercial real estate market.”

But 2017 has not started out as a comeback year, based on preliminary sales data from the first two months, which shows a continuation—and perhaps even a steepening—of transaction decline, both regionally and nationally. South Florida transaction volume was down 84 percent in January, compared to the previous January. And February sales totals were down 29 percent, according to RCA data. National volumes were down 41 percent and 31 percent, respectively.

“I think the market took a pause in the fourth quarter with a wait-and-see approach,” says Doug Mandel, senior vice president of investment sales brokerage Marcus & Millichap. “I think we are going to see a much more voluminous second half of the year.”

Already, Mandel says, there is renewed interest from sellers. However, experts predict commercial real estate prices, which have exceeded their previous peak, probably reached their crescendo in 2016.

But South Florida may see value growth from rising rents, says Todd Everett, a senior sales associate at Marcus & Millichap.

“Growing NOI [net operating income] increases value,” he says. “We have not hit the high-water mark for peak rents, so there is still runway left to grow rents.” ↵

Freelance writer Darcie Lunsford is a former real estate editor of the South Florida Business Journal. She is the senior VP for leasing at Butters Group and is avoiding a conflict of interest in her column by not covering her own deals.