I often ask entrepreneurs what their exit strategy is. It’s often having an initial stock offering, but Ultimate Software is going the other way by delisting from NASDAQ and going private in an $11 billion buyout. As a group, 10 senior executives and directors would gain $310 million from the sale of the stock, if the shares outlined in the 2018 proxy statement still apply.

Ultimate announced it has entered into a definitive agreement to be acquired by an investor group led by private equity firm Hellman & Friedman, in an all-cash transaction for $331.50 per share in cash. The price is about 32 percent over Ultimate’s average price during the 30 trading days ending February 1. Shareholders would presumably be happy with the $54.51 per share increase that had the stock trading at $332.24 on Monday morning.

The very slight premium of the trading prices compared to the deal price could indicate a sliver of people hope for an even better deal during the 50-day period that Ultimate’s board may encourage other proposals. While Ultimate’s board recommended shareholders support the deal, the company has the right to terminate the Hellman & Friedman deal if a superior proposal emerges.

Of course there is the usual fishing expedition by a law firm wanting to investigate potential claims of breach of fiduciary duty concerning the proposed deal with Hellman & Friedman. I’m skeptical that will amount to anything given the share price premium in the announced deal and the plan to be open to other offers. (Sounds like the board is exercising its fiduciary duty to me.) I also didn’t see a poison pill payment to Hellman & Friedman if the deal is killed.

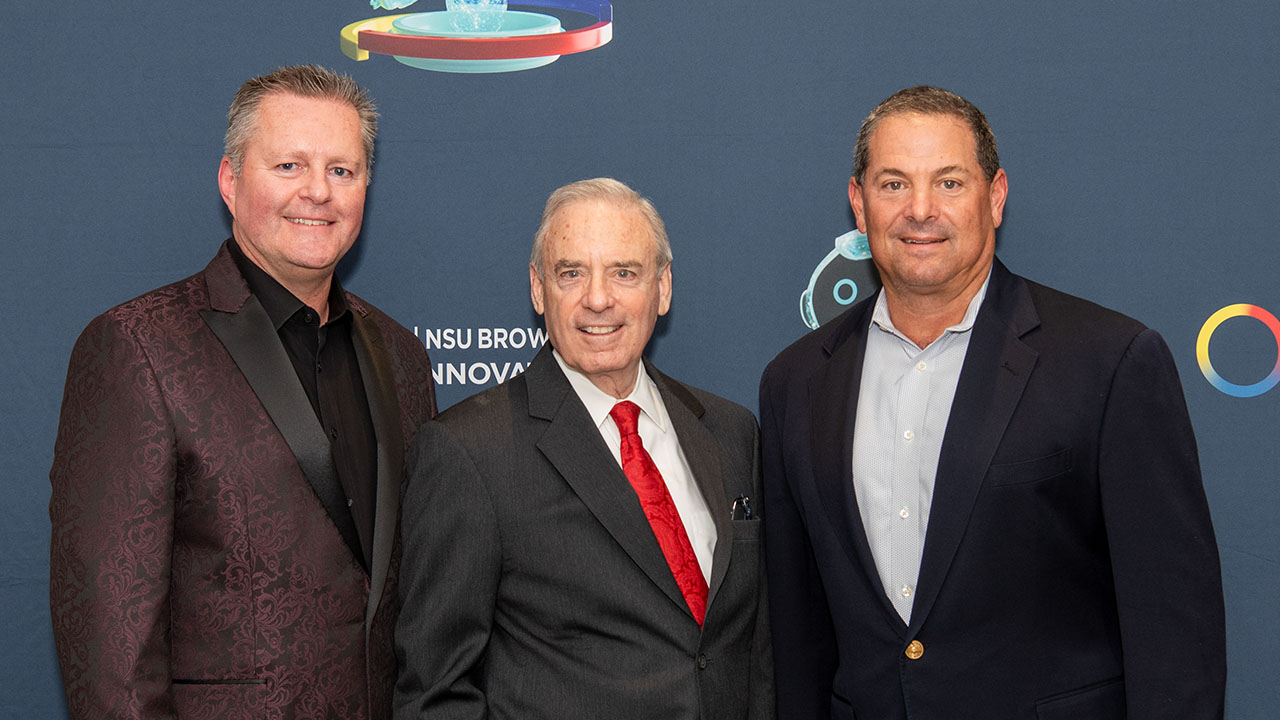

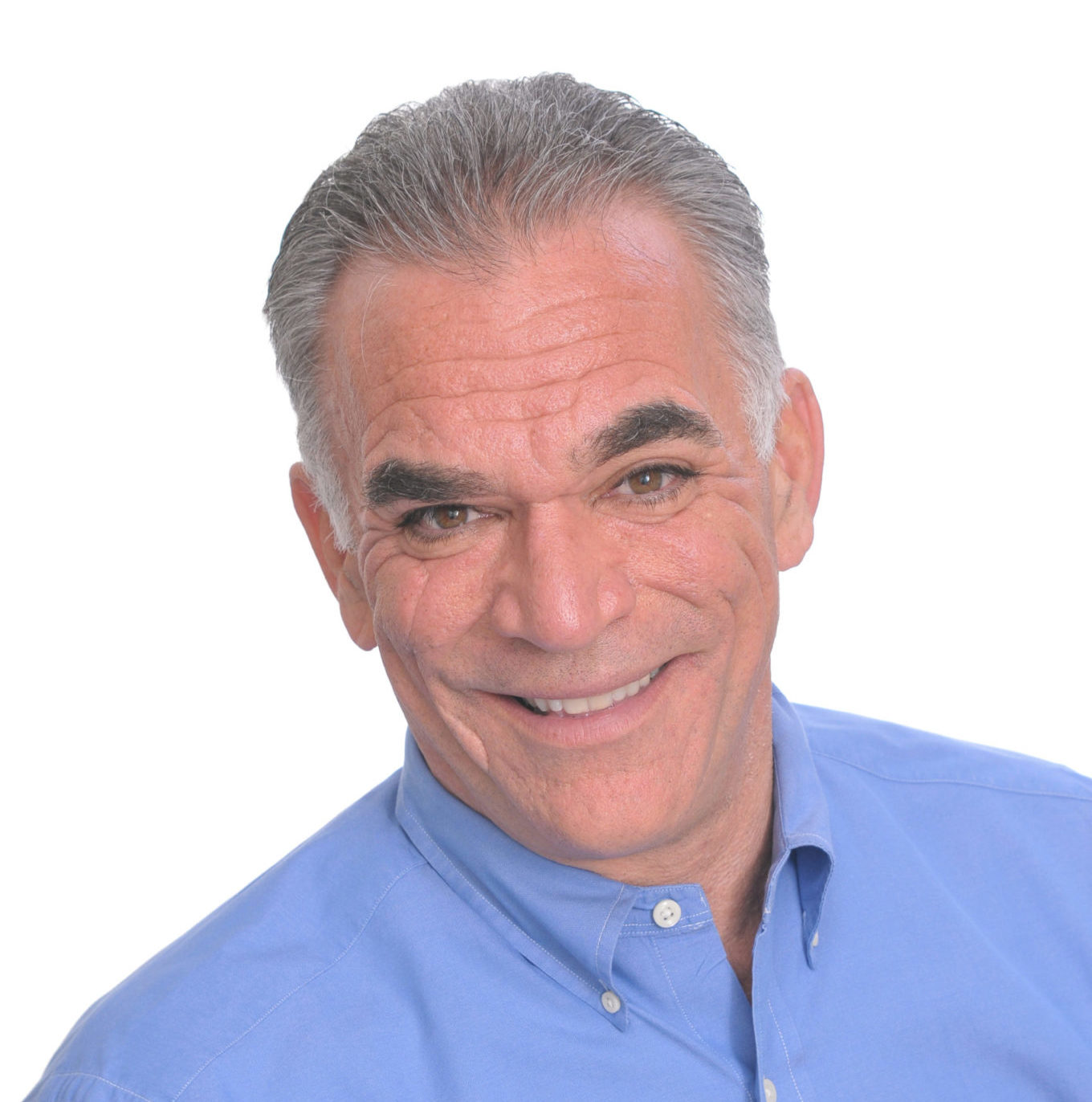

Assuming the Hellman & Friedman transaction goes through, Ultimate will continue to operate under the leadership of CEO Scott Scherr and the existing senior management team. I would think that would be viewed positively since Ultimate has a stellar record for achievement and rates well as a best place to work.

The privately held company’s new ownership will include Blackstone, GIC, and Canada Pension Plan Investment Board and JMI Equity.

“The transaction provides our stockholders with a substantial premium. Our decision was also made with the best interests of our 5,144 employees and our more than 5,600 customers at heart,” Scherr said in a statement. “This change will bring meaningful benefits to our employees and customers—both in the long and short terms. Since all of our employees are given equity in Ultimate when they join us, as stockholders, this transaction will result in immediate financial upside for them. Today’s announcement will also allow us to make additional, prudent investments in our products and services to better serve our customers.”

My decoder ring for part of Scherr’s statement: We won’t be a public company anymore that often has to worry about the balance between quarterly results and the need for long-term investment.

Ultimate likes to make its employees equity partners in the company, so a lot of employees will do very well with the merger by cashing in their shares, which are up by 50 percent over the past 12 months.

Shareholders of many mutual funds will benefit by the surge in price. The 2018 proxy listed T. Rowe Price (4.15 million shares) , FMR LLC (Fidelity) (3.37 million shares), Janus Henderson Group (3.08 million shares) BlackRock (2.38 million shares) and Vanguard Group (2.39 million shares) as the largest beneficial owners.

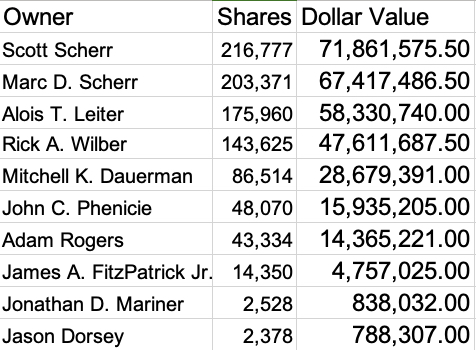

Here’s a chart of what each of the senior executives and directors listed in last year’s proxy would get if they sell the shares listed in the proxy. Some of the shares are restricted, so the amount may vary or could be outdated:

At the end of 2018, Ultimate’s total revenues exceeded $1.1 billion and the company currently serves more than 5,600 companies worldwide, with more than 48 million people records in the cloud. Ultimate will continue to develop, market, deliver, and service its suite of human capital management and employee experience solutions globally, including HR, payroll, benefits management, talent acquisition, talent management, workforce management, employee sentiment analysis, and HR service delivery.