By Darcie Lunsford

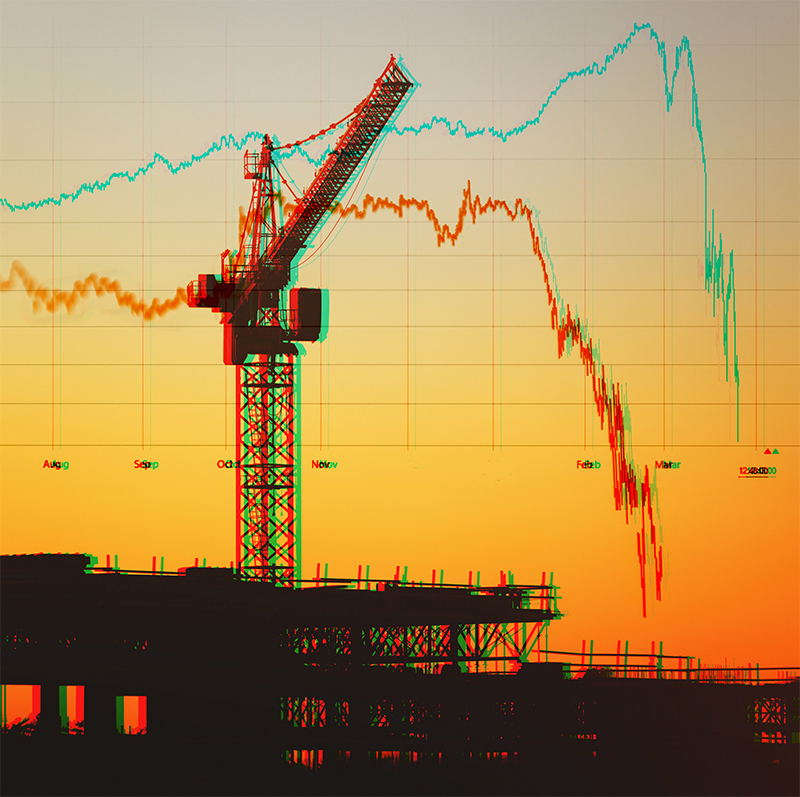

U.S. regulators continue to caution that the nation’s hot market for commercial real estate investments might be overheating.

And you don’t have to look much further than the extended period of low interest rates paired with strong investor demand—both domestically and internationally—to see the potential for a bubble.

Federal Reserve Chair Janet Yellen and Boston Fed President Eric Rosengren are among the Pavarotti-stature songbirds singing the tune that the rapid rise in commercial real estate valuations are built largely on existential stimulus, not necessarily the fundamental building blocks of rent growth and tenant demand.

Following the Fed’s late-September Federal Open Market Committee meeting, Yellen addressed the sector’s current high price-to-rent ratios and low capitalization rates under which today’s bullish commercial real estate buyers are underwriting assets.

“We’ve recently issued new supervisory guidance pertaining to commercial real estate. I would say that in the area of commercial real estate that, while valuations are high, we are seeing some tightening of lending standards and less debt growth associated with the rise in commercial real estate prices,” Yellen says. “But more generally, we’re not seeing signs of leverage building up or maturity transformation in the way that we saw in the run-up to the crisis and we’re keeping a close eye on it.”

A Fed survey found banks tightened their standards on commercial real estate loans in the second quarter even as loan demand strengthened.

“It’s possible that we will make a market correction, but it is hard to tell when a market is just a little frothy as opposed to being in a bubble,” says Mark Vitner, senior economist for Wells Fargo. “The ones that seem to be the most frothy are the ones that seem the most tied to the global economy with the most capital coming in. Miami is certainly one of those.”

Miami office sales reached $572 million in the second quarter, which was twice the amount in the first quarter, CBRE data shows.

“I think this may be one of the most dangerous phrases economists say: ‘It’s going to be different this time,’ ” Vitner says. “But it is really different this time. It really has been a big-city recovery.”

Miami, with its iconic skyline, mega-city sizzle and institutional investor allure, is unlikely to be the first spot to feel a commercial real estate cold front. Suburban markets in Palm Beach and Broward would be more likely to feel the chill first—and might already be, anecdotally.

“We are seeing a slight slowdown in inventory coming to market,” notes Scott O’Donnell, executive director for capital markets for Cushman & Wakefield in Boca Raton. But, he says, it has less to do with what the Fed is talking about—although buyers are being more prudent with acquisitions—and more to do with diminished opportunities for incoming buyers to add value to properties. “So many of the value-add properties have been stabilized and sold,” he says.

Even so, O’Donnell says: “I don’t see any kind of major pullback.” ↵

Freelance writer Darcie Lunsford is a former real estate editor of the South Florida Business Journal. She is the senior VP for leasing at Butters Group, and she avoids conflicts of interest in her column by not covering her own deals.