We’re doing a better job of saving money, but it’s not good enough yet.

You may have heard that Americans are bad at saving money, but exactly what does that mean? The personal savings rate is simply defined as the amount of money you’ve saved as a percentage of your disposable personal income, and the latest data tells us why Americans may not be as prepared for retirement and emergency expenses as they should be.

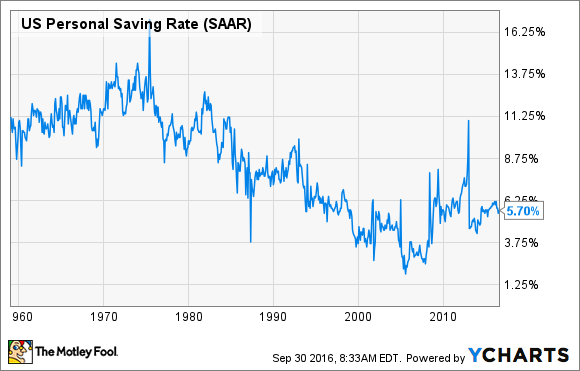

The personal savings rate in America

According to the latest data from the U.S. Bureau of Economic Analysis, the personal saving rate in the United States is 5.7%. This means that out of every $100 in after-tax income Americans bring in, approximately $5.70 is being saved for things like retirement, emergency expenses, and rainy-day savings.

First, the bad news. This is far too low to adequately prepare most people for retirement and unexpected expenses, which we’ll get into in more detail later on. Most experts recommend saving at least 10% to 15% of your income in order to be financially well-prepared for these things.

However, the good news is that we’re getting better. The personal savings rate has dramatically improved since before the financial crisis in 2008, when it hit an all-time low of just 1.9%. However, as you can see, we’re still saving relatively little from a historical perspective.

U.S. PERSONAL SAVING RATE DATA BY YCHARTS.

Furthermore, a recent study (link opens PDF) by Fidelity found that the savings rate (including employer retirement contributions) has improved to 8.5% from 7.3% in 2013. Millennials posted the most impressive improvement, increasing their median savings rate to 7.5% from 5.7%, and baby boomers are the best savers, putting away 9.7% of their income — a big improvement from 8.1% just three years ago.

| Age Group | 2016 Savings Rate (Including Employer Match) |

|---|---|

| Millennials (25-34) | 7.5% |

| Generation X (35-50) | 8.2% |

| Baby boomers (51-69) | 9.7% |

| Overall savings rate | 8.5% |

DATA SOURCE: FIDELITY.

How much should we be saving, and what should we be doing with it?

The short answer is that you should be saving between 10% to 15% of your income. Fidelity recommends a minimum of 15%, but keep in mind that this includes any employer matching retirement contributions. So, if your employer contributes say, 4% of your salary to your 401(k), this implies that you should be saving 11% of your income.

However, what you do with the money you save can be just as important as how much you’re saving. For starters, you should be using the tax-advantaged retirement saving options available to you, such as your 401(k) or IRA. The tax benefits of these accounts can make a huge difference over time, and could also get you an immediate tax break, depending on your account type and income level.

Once you’ve put your savings in the right type of account, it’s important to allocate your assets in an age-appropriate manner. Here’s a good primer on asset allocation, but in a nutshell, this means that you don’t want to be too conservative when you’re young and have time for your money to grow, and you also don’t want to take on too much risk as you’re approaching retirement age and can’t afford to lose a big chunk of your nest egg.

For example, if you’re 30 and have $20,000 in retirement savings in CDs and money market accounts, you could actually end up costing yourself more than $180,000 over the next 30 years based on the historical returns of a more age-appropriate 80%/20% stock and bond mix. On the other side of things, if you’re 65 and have your $1 million nest egg completely invested in an aggressive stock fund, a recession or market crash could wipe out hundreds of thousands of dollars of your hard-earned savings.

As far as an emergency fund is concerned, a savings account is fine. The point of an emergency fund is for your money to be readily accessible when you need it. Experts generally suggest setting aside six months’ worth of expenses, but any increase in your emergency savings is helpful. After all, an emergency stash of just $400 puts you in better shape than about half of all Americans.

The bottom line on savings

Americans are getting better about saving, but we still have a long way to go before it’s really enough. The three keys to long-term financial success are simple – save more money, put it in the right places, and allocate it wisely. If you do all of those well, your dream of financial freedom could become a reality.

The $15,834 Social Security bonus you could be missing

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.