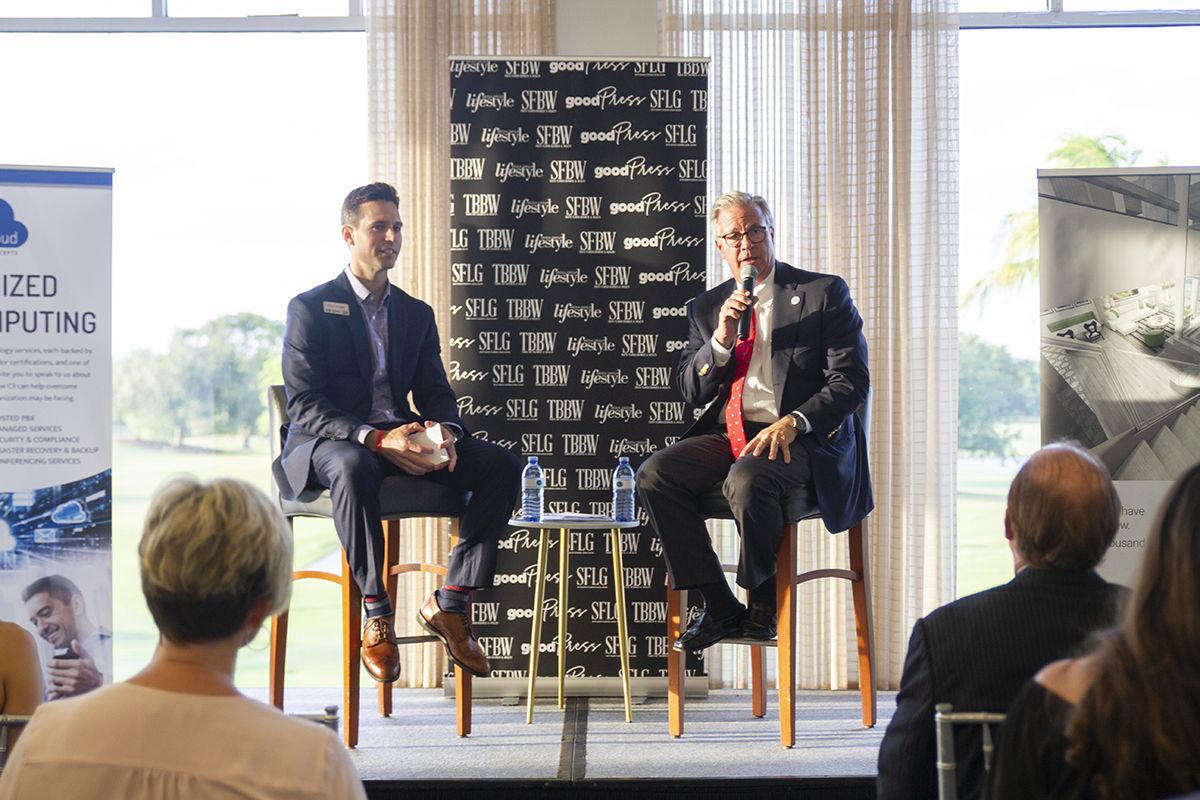

Albert Santalo talks about CareCloud and his latest ventures

Albert Santalo is a computer scientist who has become one of the top serial entrepreneurs in South Florida.

He has raised more than $100 million in equity capital from venture and angel investors for companies he has founded. Most recently, he founded 8base, a technology company looking to revolutionize the enterprise software industry, and co-founded Thrillient, a financial technology and processing company.

Previously, he was founder, chairman and CEO of CareCloud, an IT health care company, and Avisena, a venture-backed revenue cycle management company for physicians.

Santalo is the recipient of Florida International University’s 2004 Charles E. Perry Visionary Award and was inducted to the FIU Entrepreneurship Hall of Fame in 2006. Santalo was born in Baltimore to Cuban parents and moved to Miami at age 11. He graduated from Christopher Columbus High School, studied computer science at the University of Miami, and has a master’s degree in business from FIU.

This edition of CEO Connect was held at Prestige Imports Lamborghini in North Miami. Santalo was interviewed by SFBW Chairman and CEO Gary Press with some questions at the end from the audience. The following transcript has been edited for brevity and clarity.

You joined Answerthink when it was a startup in 1997. What drew you there, and what experience did you gain?

I had just finished my MBA. My whole plan was to start a health technology company, but I got lured into Answerthink. I thought it was too good of an opportunity to pass up. Ted Fernandez, who was the national partner in charge of KPMG Strategic Consulting Services, had left and raised $20 million of venture capital. I got the opportunity to come in and get founder shares.

We all know you have to get experience before you go out on your own.

It’s gotten a lot easier to start companies, but I think it’s good to get some experience. I think if a person gets an opportunity to start a company in their 20s these days, I think that’s the right pursuit—assuming they have the DNA to do it.

What compelled you to start your own company?

Before CareCloud, I had started another company in 2001, Avisena, which was also a health care technology company. That was a very terrifying experience.

I was 32. I was out there trying to raise money trying to be a tech entrepreneur, trying to be CEO for the first time in an environment where the dot-coms were just blowing up. The economy was in the tank. I had to invest my own money and go without pay. I managed to get through it, built the company successfully, raised the money we needed.

In 2008, I ended up leaving and thinking about what was next. I had the contacts to raise the money. We do live in South Florida and there is an abundance of high net worth individuals. I had been able to perfect the playbook of starting a company with private capital. We raised a little under $3 million, all from private individuals.

You built up Avisena. What made you make the leap after you built up that company?

In short, it was investor dysfunction. It was one of those moments in a person’s life where they think about and decide who they are. One of those moments where you can capitulate and say, “I could stay on board and do the wrong thing.” I’ve worked six years in this company and built it up successfully, but I never saw a pattern of success based on what certain investors were pushing and I felt like it was against my principles, so I walked away.

The second time with CareCloud?

I got CareCloud up to about $25 million in revenue and the board was beginning to impose certain management decisions on me, mostly around key personnel, and some of that stuff didn’t work. It’s the kind of situation where I was asked to step down. After six months of being in a different role, I felt like life was too short.

What’s your advice for entrepreneurs? What is your advice for people who want to take that leap but are a little scared?

What I’ve always done is study what happens in Silicon Valley and maintain contacts there, but adapt that playbook to South Florida. We don’t have the same resources where you look at capital, engineering talent, even professionals such as lawyers or accountants that know how to support technology companies.

One of the things that has made me successful is I prepare a lot before I pitch to investors. We all believe in it and are going to drive returns and not go off and do some crazy idea that’s not going to work.

How do you work with investors to get clear-cut expectations so that you stay on the same page as much as you can?

You can make a lot of mistakes with private investors, such as overpromising things and giving away too many things. For instance, if private investors have the rights to block things, that can lead to dysfunction that isn’t good for investors. It’s being able to orchestrate the right kind of deals in a private setting.

Then, in venture settings, venture capitalists—regardless of what percentage of the company they own—are going to try to impose control provisions and protective provisions. Unless you are Facebook or Google, you are probably going to have to live with them.

The important thing, No. 1—and this is an absolute—is integrity. You have to be honest and you have to show up with the bad news and deliver it early. You have to create a structure of transparency and try really, really hard to recruit the best team and build a highly scalable model.

Can you tell us a little about your current ventures?

The first one is Thrillient, which is really helping with merchant processing and credit card processing. I have a team in place that’s operating the company day-to-day. I’m spending a little bit of time there, but most of my time is being spent on 8base, which is a very, very disruptive software company.

We are developing a product that allows business people to roll out enterprise software and do it very quickly. It’s very powerful and very scalable enterprise software without developers. So, it’s literally cutting out developers, architects, dev-ops [development and perations], designers out of the process.

What type of company would it make sense to use it?

Just about any type of company. If they want to track customers and they go out and buy Salesforce.com, it costs you a fortune. There are other solutions—they may or may not be good—and then you may have to buy a marketing automation software and you may have to buy accounting software, billing software and HR software. Before you know it, you are spending tens of thousands a month that most small businesses cannot afford on all of this stitched-together software.

Imagine that you had a software framework that could drop into your business like water and could fill the container. You could do it at a much lower cost, get better technology, not have to ever worry about backups and disaster recovery and, if the business triples in size, not worrying about the computing infrastructure. All of that is automatically taken care of for you.

Tell me a bit more about Thrillient. How are you doing merchant processing differently?

One of the last things I did at CareCloud before I stepped out was a strategic deal with First Data Corp., which is the largest credit card processing company in the world. My contact there, the CEO, and I sat down and he showed me a vision of where the company was going. I ended up designing a product at CareCloud that lives on that platform. It’s called Clover. First Data ended up investing in CareCloud and brought along PNC, and they ended up doing an investment of about $12 million. I fell in love with where that industry is going. The dialogue that needs to happen is: How do we elevate your capabilities, using new technology at the point of sale, loyalty programs, gift card programs, all of these kind of things that help the merchants elevate the conversation and their capabilities?

What are the rising trends in technology?

Technology such as artificial intelligence and driverless cars and drones are going to completely eliminate jobs. You think about truck drivers, taxi drivers, even Uber drivers—all sorts of professionals, cashiers, clerks, even certain elements of accounting and law. All of these things are quickly being taken out. I worry about the future of jobs and society. I’m not a proponent of stopping the trains, but I really don’t have a clear answer for what the solution is.

What keeps you up at night?

People more than anything. I love people. People are your best opportunity and your biggest challenge. You can’t be successful without them, but you have to treat them as individuals. That means you are going to have to deal with their individual problems and the problems they bring you, the challenges of motivating them and managing them and so forth. Always trying to look for the best people and having them bring their “A” game is what keeps me up more than anything.

You said earlier, when I asked about taking a risk and being an entrepreneur, that they have to have the right DNA. What do you look for when you are talking to someone?

What I look for is an entrepreneur who is willing to listen, tries to apply what they’ve heard and do it quickly. They are resourceful. They have grit. They are going to be able to see it through when the tough times come because they always come. They have a true vision. That they are going to be able to hire great people and are going to sit in front of a VC [venture capitalist] who will say they are backable.

Ever work with somebody that you thought was brilliant but had tough people skills? How do you coach and mentor that person?

I’ve screwed this up a lot. Avisena and CareCloud got up to 250 [employees] and I always made it a point that I did the new-hire orientation. I was there to tell them about the values and what to expect and what we expected from them. I would always draw this quadrant, which was borrowed from GE. One dimension was fit and the other was performance. The way I would explain it was if you were in the lower right-hand quadrant, those were the people we should never hire. If they aren’t a fit and don’t perform, you’ve got to screen them in the HR process.

If they are in the high-fit, low-per-formance quadrant, you have to work to get them in the upper left-hand quadrant. You have to mentor, support them because they have great attitudes.

The people in the upper left are your “A” players. Your challenge is, how do you give them enough opportunity and pay to keep them? But it’s what you do with that remaining quadrant that makes a difference. These are the people that perform, but don’t fit. I’ve tried to become more rigid about this. I’ve tried to kind of patch up my mistakes in hiring to make sure I get it right.

There’s a book called “The No-Asshole Rule.” That’s the best way to describe our policy about the lower left-hand quadrant.

I’m a headhunter and I have been recruiting 30 years and I have two children at home, 12 and 14. I have no career advice that I can give them because technology is changing things so quickly. What would you give them as career advice?

The important thing is to become really good at people skills—ideally, in the ability to manage others, to hire, inspire and lead others to success. Develop sales skills in whatever way those are applied. Have technology skills. That doesn’t mean they have to code, but to have computational thinking woven into who they are, so they can understand that this is how business operates and how can you bring technology to operate it properly.

What is one mistake you made that was a great lesson?

I think all my key mistakes—and 90 percent of CEOs will answer the same way—is not getting rid of a person fast enough. ↵

About CEO Connect

SFBW’s CEO Connect series is an exclusive, invitation-only monthly event that brings together South Florida’s top business leaders to meet, mingle and talk among their peers.

The presenting sponsor is Celebrity Cruises. Gold sponsors include Greenspoon Marder, Shorecrest Construction, TD Bank and Optime Consulting.

The evening begins with a cocktail reception for about 100 guests followed by the highlight of the event, a live interview between Gary Press, SFBW chairman and CEO, and a well-known C-level executive providing insight into their personal lives, careers and views on issues affecting the business community.

Partnering with SFBW on this exclusive event provides an opportunity to network with the area’s business elite, generate new business opportunities, and increase brand awareness. For information about event sponsorship opportunities, email Clayton Idle at cidle@sfbwmag.com.