Arnaud Sitbon Founder, President and CEO of ESJ Capital Partners, which today is involved in the ownership and management of more than 3.6 million square feet of educational facilities, shopping centers, multi-family and commercial real estate across the country.

Before moving from France to the United States, Sitbon was involved directly in the management of a real estate investment group in France, which owns and manages more than 1 million square feet of prime office and retail properties in Paris.

He is a Florida-licensed real estate broker and a certified commercial investment member designee. He holds a master’s degree in real estate management and development from the University of Paris-Dauphine.

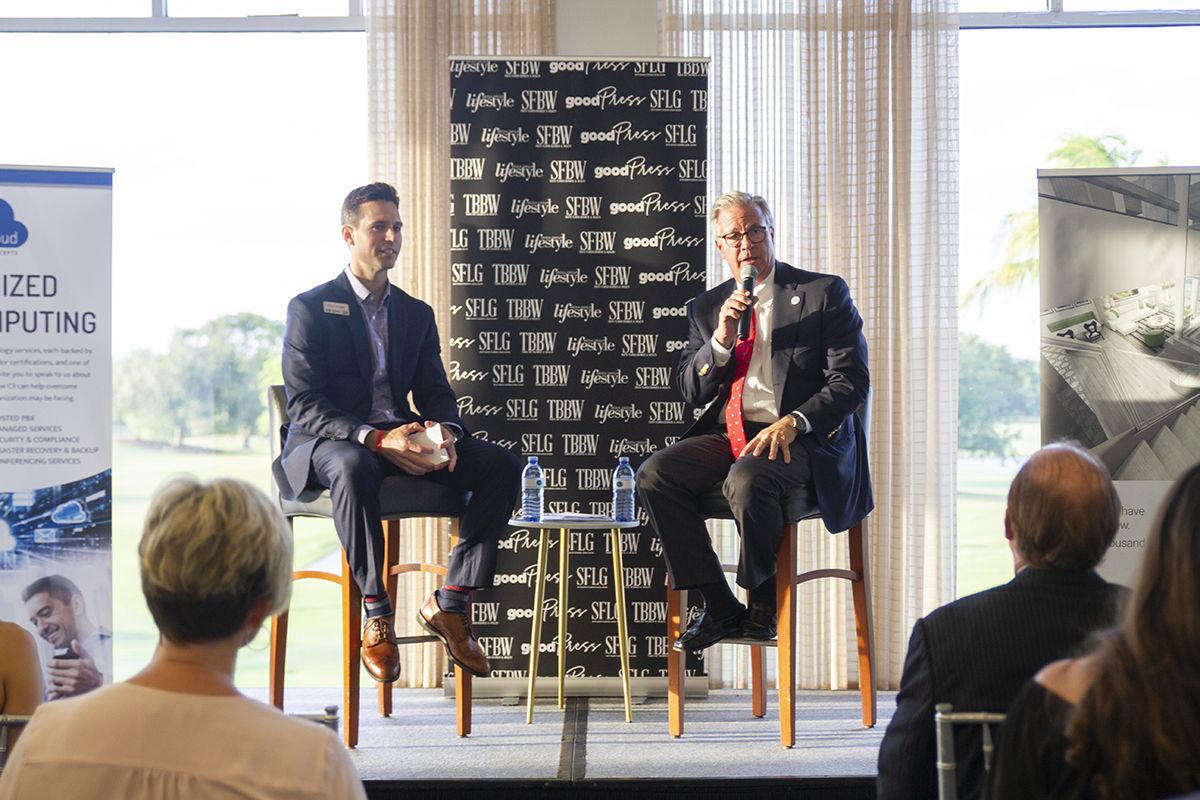

For this edition of CEO Connect, SFBW chairman and CEO Gary Press interviewed Sitbon at the SLS Brickell hotel in Miami. This interview has been edited for brevity and clarity.

What made you leave France and decide to come to South Florida?

In 2002, I started thinking I wanted to move somewhere else. And I thought the U.S. was a good place for me. Out of all the different cities, Miami, Florida, seemed to be the most promising.

Was there a reason why you wanted to leave France at the time?

My parents are Jewish and were born in Tunisia. And I didn’t expect anything serious to happen in France, but I felt that it would take years for Jews to feel welcome in France. And I wanted my kids to have the chance to settle in a place where I would believe they would be welcome.

What is the vision for ESJ?

ESJ Capital Partners is a full-service asset management firm. We are SEC-registered and we also are registered in Luxembourg. We offer our investors [opportunities] to invest in different types of real estate. ESJ stands for “equity,” “syndication” and “joint venture.” The idea behind our company is that we offer good investments but also the right partner to do it. By picking the right partner, and the right developer, we can invest the best we can.

What does your average investor look like?

Well, we have a range of investors from the high net worth individuals to the institutional. Sixty percent of our investors are European-based. That’s where [I] and my partner come from.

What do the international investors think about South Florida as a place to invest?

Investors are coming from all over the world to invest in the U.S. With the administration we have, this is probably one of the safest places to invest. The U.S. is seen as king of the castle. Florida is seen as a business-friendly place because there’s no state tax. It also has the beach and is an amazing place.

When you look at the real estate market, which area are you most cautious about?

We are always cautious about what people pay for their rates. I do believe there are a lot of people who do overpay for the rates they are getting. So, when we are looking at opportunities, we look at the business we are underwriting to see if it would be self-sufficient—that they will be able to pay the rent, but also be able to generate a profit.

You’ve been involved in a number of charter school properties. Would you please tell us about the opportunity you found there?

Yes, we have been very focused on developing charter schools on the real estate side. And we had the first opportunity [when] my partner came to me with an idea for a charter school project. When I looked at the potentials for the terms, it made a lot of sense and seemed to be a real solution. I realized it was cheaper for parents to send their kids to [a charter] school than to private school, so that makes sense for the community and we want to help communities.

As you know, Florida has had a long history of boom and bust. Where do you think we are in the cycle now?

When I look at Miami’s history, it’s like this—what goes up must come down. I don’t think that we are at the end of the cycle. I think the way developers are structuring financing of their projects is making them less vulnerable.