Keith Costello leads a rapidly-growing community bank for social change

Keith Costello is the president and CEO of First Green Bank, a community bank with $650 million in assets. A 25-year veteran of financial services, Costello has been featured in numerous local, regional and national media, and he often serves as a speaker and panelist for financial events and conferences. He started his career as a financial consultant at Merrill Lynch in 1987 after leaving the U.S. Army as a captain.

Until October 2015, Costello served as Division President, South East Florida Region with Centennial Bank. He began this role as a condition of the sale of Broward Bank of Commerce, which was purchased to Home BancShares, (Centennial Bank HOMB: Nasdaq), in October 2014 at one of the top valuations since the recession. At the time of the purchase, he served as president and CEO and was an organizing director of Broward Bank of Commerce, headquartered in Fort Lauderdale. Broward Bank of Commerce was one of the last new banks chartered in the United States opening in January of 2009.

Costello has a bachelor’s degree from the University of Tampa and an MBA from the University of Miami. He also is a chartered financial analyst. He is on Fort Lauderdale’s Economic Development Advisory Board and the chairman of the Greater Fort Lauderdale Chamber of Commerce.

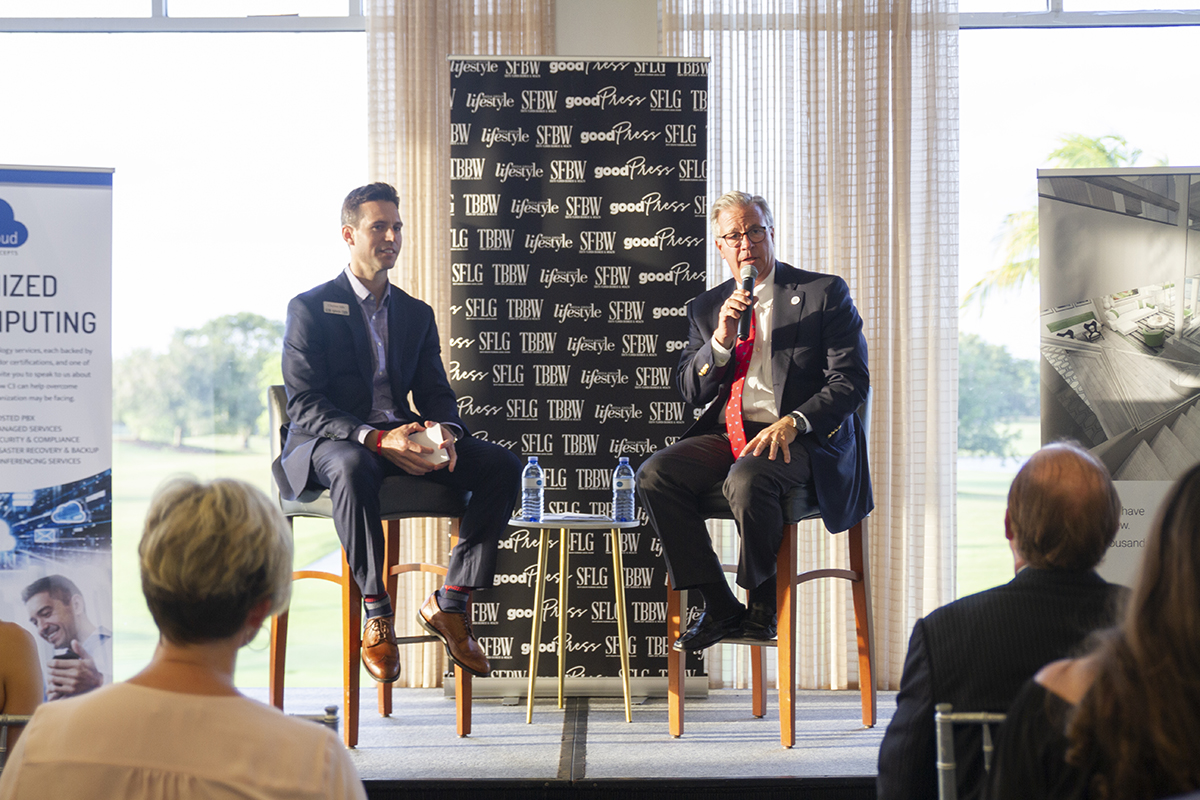

SFBW Chairman and CEO Gary Press interviewed Costello at the Pelican Grand Beach Resort in Fort Lauderdale. The following transcript has been edited for clarity and brevity.

How did First Green Bank get its name, and how does it exemplify its values-based business model?

First Green Bank started in Central Florida with Ken LaRoe, who lives in Mount Dora. Ken was very passionate about the environment and wanted a bank that was environmentally friendly and was concerned about doing something for society.

We opened our Fort Lauderdale branch last summer on Davie Boulevard.

We eventually joined an organization, Global Alliance for Banking on Values. It’s funny, in Mount Dora, it’s really a rural area, so people weren’t buying into environmental problems. But when we opened in Orlando and in South Florida, we found that people do relate to what’s going on in the environment, with sea level rise being a big concern. We are big advocates for doing something about sea level rise, big advocates for solar energy.

First Green has extensive benefits, including paying 100 percent of health care insurance premiums, 100 percent of life insurance, short-term disability and long-term disability premiums. Have you been able to measure how this impacts recruitment and retention?

We also pay a living wage. In the banking industry, you have people working as tellers and back office people, so then again, it goes along with our social mission that we want to make sure that our employees are well taken care of. And we think it pays off in employee loyalty and in the way our employees treat our customers, too, because they feel that they are really well taken care of.

What’s the bank’s game plan in the near term and long term?

Last year in June, we were at $415 million in assets. We have grown that to about $650 million, so we had almost 60 percent growth in a year, which makes us one of the fastest organically growing banks in the state.

A lot of that has been driven by the fact that we have this great team. To be able to grow like that has been easy for us. Moving forward, it may not be as easy. We are building our South Florida headquarters in Fort Lauderdale.

We want to make it a technology-driven and community-oriented office. We want to make it interactive, put in a gym, a cafe, a community center and have activities that will bring people together.

What would you like to see in terms of rollback of federal rules for banking?

The new administration is much more pro-business than the last administration. Bank stocks were up tremendously just because of the fact that there’s a perception that there will be less regulation.

Community banks have been the backbone of small business lending for years.

There used to be more than 300 banks in Florida. There are now 130—it’s not economically viable with the existing regulations. With the large amount of capital that they are now requiring to start, it doesn’t make sense economically. It’s that one hurdle they need to get over, where they allow banks to start with less capital.

There’s concern over whether South Florida has a condominium glut. First Green recently granted a $12.72 million loan for the Wave on Bayshore—do you still see opportunities in the market?

I think in Broward County, we aren’t seeing as much construction as Miami-Dade, but what we have looked at is quality developers, smaller projects where our risk was limited. We aren’t doing massive construction projects.

What are your thoughts on where we are in the business cycle in general?

I belong to Vistage, a CEO group that is worldwide and a very respected organization. We are CEOs who help other CEOs at becoming better at running their business. It is thought that we will have a downturn in 2019—but it won’t affect businesses too severely. Through 2020-29, it’s going to be a good 12 years.

That’s how we are operating our business now.

What are your goals as chairman of the Greater Fort Lauderdale Chamber of Commerce?

I’ve been involved in the chamber for 30 years. This year, we are focused on regionalism, which has become a big issue. So are transportation, coastal resiliency, sea level rise and community-based real estate developments. We are really concerned now since there are a lot of people in Fort Lauderdale who don’t want to see any more development because traffic is terrible. So, there’s a backlash with citizens. And we all know that one of the reasons we are doing so well right now is because of development.

We have to be careful in how we address this.

Who has been important as a mentor and why?

I had a couple. Bill Allen, who was a legend in Miami. He died two years ago. And the other person is Leonard Abess Jr., chairman of City National Bank before it was sold. I worked from 1997 to 2005 there, and Leonard really took me under his wing and taught me banking. ↵

About CEO Connect

SFBW’s CEO Connect series is an exclusive, invitation-only monthly event that brings together South Florida’s top business leaders to meet and mingle.

The presenting sponsor is Celebrity Cruises. Gold sponsors include Greenspoon Marder, Shorecrest Construction, TD Bank, Optime Consulting and Pelican Grand Beach Resort.

The evening begins with a cocktail reception for about 100 guests followed by the highlight of the event, a live interview conducted by Gary Press, SFBW chairman and CEO, and a well-known C-level executive providing insight into their personal lives, careers and views on issues affecting the business community.

Partnering with SFBW on this exclusive event provides an opportunity to network with the area’s business elite, generate new business opportunities, and increase brand awareness. For information about event sponsorship opportunities, email Clayton Idle at cidle@sfbwmag.com.